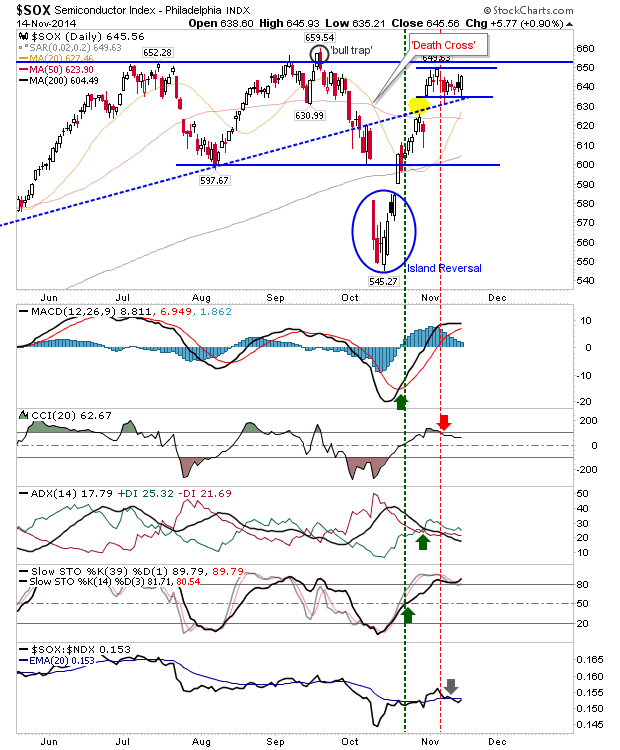

Minor Gains Continue as Semiconductors Shape Handle

While I'm late with this weekend's update there was very little to add from Thursday. Best of the action remains in the Semiconductors, which is shaping a solid handle in preparation for a possible break higher (ignore the 'Death Cross' between 20-d and 50-d MAs - this is now a 'Golden Cross').