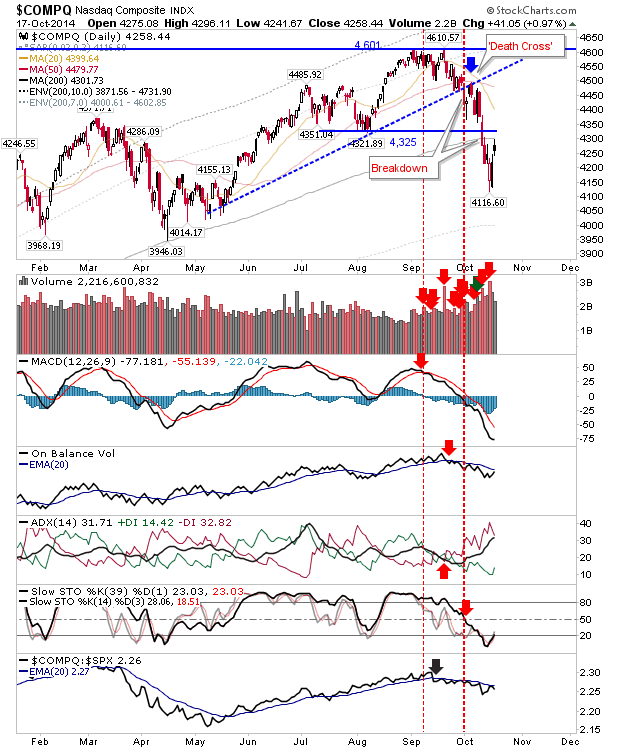

Bulls Work on Establishing a Market Low

Friday's gains helped put some distance on Wednesday's spike reversals. This will offer bulls something to defend when selling inevitable returns. Friday's action didn't all go bulls' way as key moving averages played a role in halting the advance for a couple of indices. In the case of the Nasdaq, the blocker was the 200-day MA. Friday's high tagged the 200-day MA before weakening - although there was a bit of a recovery into the close. The index is no longer oversold, giving bears an opportunity to turn the screw again. However, a close above the 200-day MA would give bulls confidence that last week was a low of note.