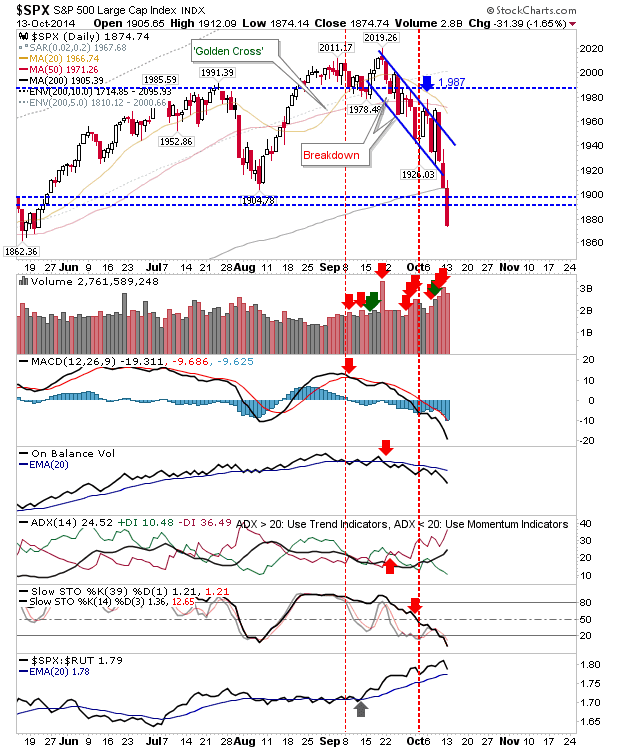

Third Big Sell Off in a Row.

The S&P took another big hit to the face as sellers rushed to the exits in late afternoon trading. The 200-day MA was barely noticed on the way down and the August swing low cleanly sliced. Technicals are oversold and volume is in line with a capitulation, although I would be more comfortable calling a bottom once the index is at least 10% below its 200-day MA (which is 1,714).

The Nasdaq did tag the 200-day MA intraday, but was unable to regain the 200-day MA. The next support level is the April low, although anywhere inside the scrappy April-May congestion would probably act as a sufficient test of support.

The Russell 2000 may actually be ready for a bounce. Today's inverse hammer marks a bullish turn as other indices struggled. The index is at channel support, and there is a sharp improvement in relative performance to Large Caps and Tech. A stop on a loss of today's low is a relatively low risk play given the volatility. Watch for a bullish morning star (starting with a gap higher).

No surprise to see another big loss in the previously quite resilient Dow. It had already undercut the 200-day MA on Friday's close, and broke key support level connecting early summer action and the August swing low.

Finally, the Semiconductor Index continued its rout with a 2% loss, following a brief incursion into Friday's action.

As for tomorrow, bulls will probably be fearful, but the Russell 2000 does look ready for a decent bounce. Shorts will be looking at overhead MAs and/or support to build positions.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq did tag the 200-day MA intraday, but was unable to regain the 200-day MA. The next support level is the April low, although anywhere inside the scrappy April-May congestion would probably act as a sufficient test of support.

The Russell 2000 may actually be ready for a bounce. Today's inverse hammer marks a bullish turn as other indices struggled. The index is at channel support, and there is a sharp improvement in relative performance to Large Caps and Tech. A stop on a loss of today's low is a relatively low risk play given the volatility. Watch for a bullish morning star (starting with a gap higher).

No surprise to see another big loss in the previously quite resilient Dow. It had already undercut the 200-day MA on Friday's close, and broke key support level connecting early summer action and the August swing low.

Finally, the Semiconductor Index continued its rout with a 2% loss, following a brief incursion into Friday's action.

As for tomorrow, bulls will probably be fearful, but the Russell 2000 does look ready for a decent bounce. Shorts will be looking at overhead MAs and/or support to build positions.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!