Daily Market Commentary: 20-day Moving Averages Hold For Now

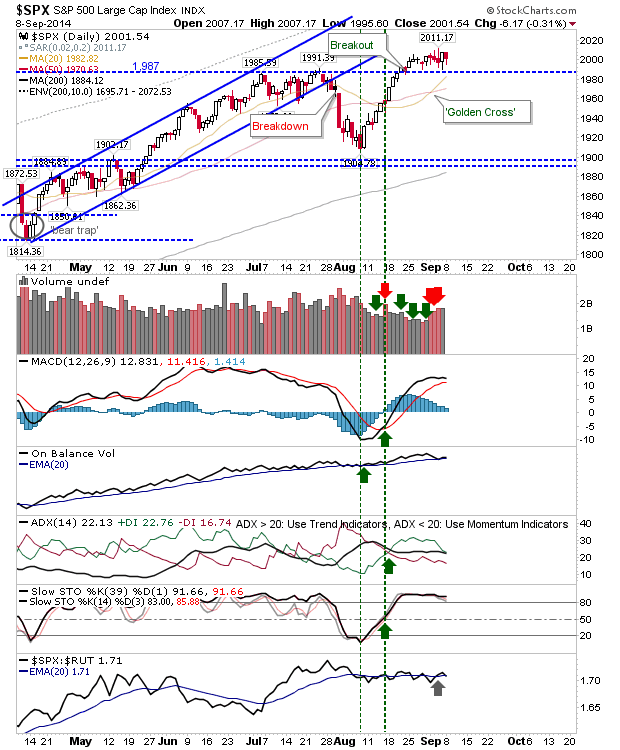

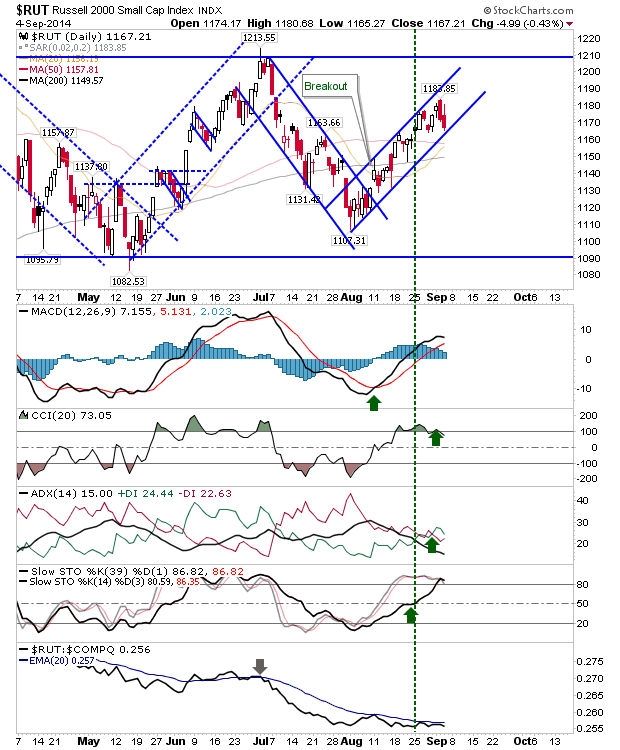

Buyers made inroads into yesterday's relatively mild losses. The point of defense were 20-day MAs of the S&P, Dow, Nasdaq and Nasdaq 100. The Russell 2000 found its love at the 50-day MA, although the 20-day MA is only a few points above it. While this offers near term upside opportunity, it has been rare for the 20-day MA to act as a launch point for a longer rally. Don't be surprised if this MA is again revisited next week. The S&P has perhaps the most to gain given the significance of 1,987 support as it looks to push beyond the psychological 2,000 level. If there is a concern it's that technicals are favouring an expansion of the weakness: a move to the 50-day MA may be needed first.