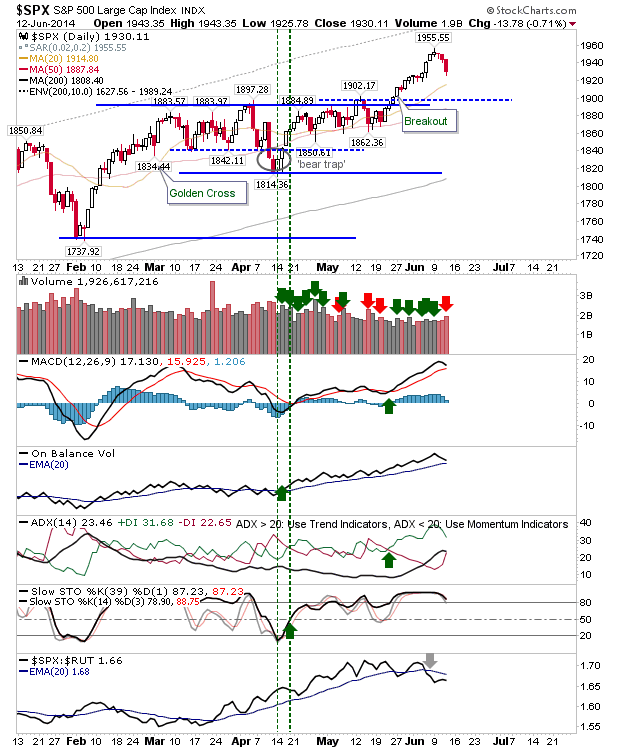

Bulls didn't want to offer bears any confidence and Friday's low volume (small) gain was enough to keep them away. Optimist bulls could say Friday finished with bullish inside days/bullish doji - but such patterns only have merit in oversold markets, and this is not an oversold market. However, there are plenty of long term bulls (me included) who have limited skin in the game and are looking at opportunities to get in. I'm waiting for a 10% discount on the 200-day MA, but others won't be so patient and may look to nibble on Monday. For the S&P, the 20-day MA is fast approaching the market even if the S&P is dawdling down to the MA. The S&P may kick on once the 20-day MA is tested.