Daily Market Commentary: Shorts Can't Bear To Look

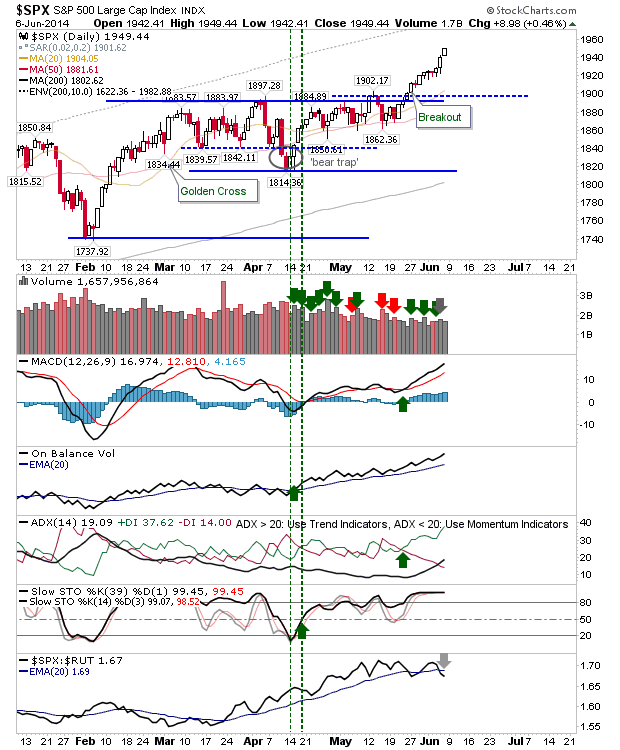

Each day has become another twist of the screw for bears and shorts. While it may be hard to be a buyer at these levels, it's even more difficult to be a short. The S&P added nearly half a percent on light volume; technicals remaining firm.