Daily Market Commentary: Big Loss Inside Range

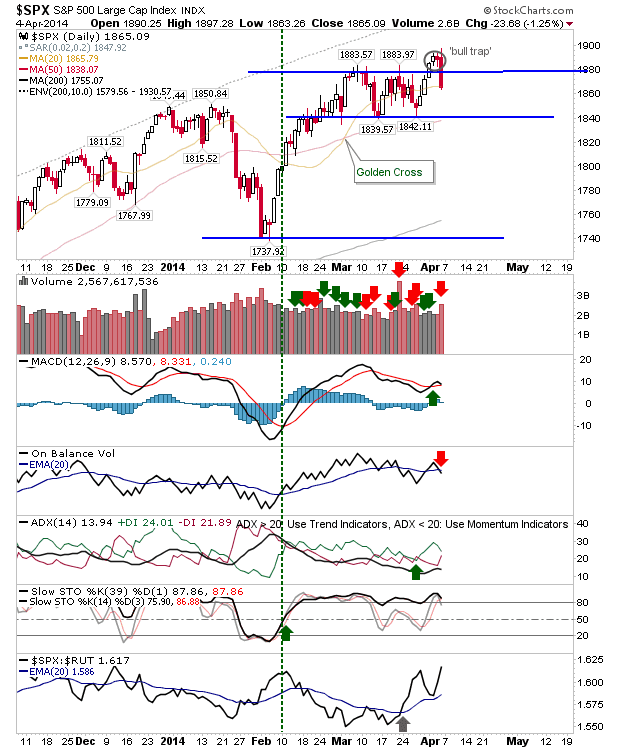

Large losses on weak jobs data offered bears an opportunity to go on the offensive. The S&P was least affected by Friday's sell off, but still enough to finish the day with a 'bull trap'. There was also a 'sell' trigger in On-Balance-Volume.

The Nasdaq took the largest hit of the indices. Volume climbed in confirmed distribution as the 20-day MA played as resistance. However, the index finished on downward channel support. Given the degree of loss, and the presence of support, a bounce on Monday is a strong possibility.

The Nasdaq 100 came off a failed test of former support turned resistance. The 20-day MA again playing as resistance. Should the index bounce from here, look for further selling action at the 20-day MA.

The Nasdaq Bullish Percents look ready to push to a new swing low, but are some way from an oversold state typical of strong swing low - as was the case in 2011.

And the Nasdaq Summation Index has struggled since late last year to regain the bullish momentum which governed the early part of 2013. The past three peaks have exhibited a significant bearish divergence to price action - supported by weakish technicals.

The Russell 2000 fell deeper inside its consolidation, undercutting its 50-day MA (and holding its 20-day MA as resistance), but remains some distance above its 200-day MA. Technicals are also mixed.

Monday is set up for a recovery bounce, particularly for the Nasdaq which finished Friday at channel support. Sellers will likely to look to the 20-day MAs again to attack and maintain the momentum built off recent large one-day sell offs.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq took the largest hit of the indices. Volume climbed in confirmed distribution as the 20-day MA played as resistance. However, the index finished on downward channel support. Given the degree of loss, and the presence of support, a bounce on Monday is a strong possibility.

The Nasdaq Bullish Percents look ready to push to a new swing low, but are some way from an oversold state typical of strong swing low - as was the case in 2011.

And the Nasdaq Summation Index has struggled since late last year to regain the bullish momentum which governed the early part of 2013. The past three peaks have exhibited a significant bearish divergence to price action - supported by weakish technicals.

The Russell 2000 fell deeper inside its consolidation, undercutting its 50-day MA (and holding its 20-day MA as resistance), but remains some distance above its 200-day MA. Technicals are also mixed.

Monday is set up for a recovery bounce, particularly for the Nasdaq which finished Friday at channel support. Sellers will likely to look to the 20-day MAs again to attack and maintain the momentum built off recent large one-day sell offs.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!