Daily Market Commentary: Semiconductors Charge Again

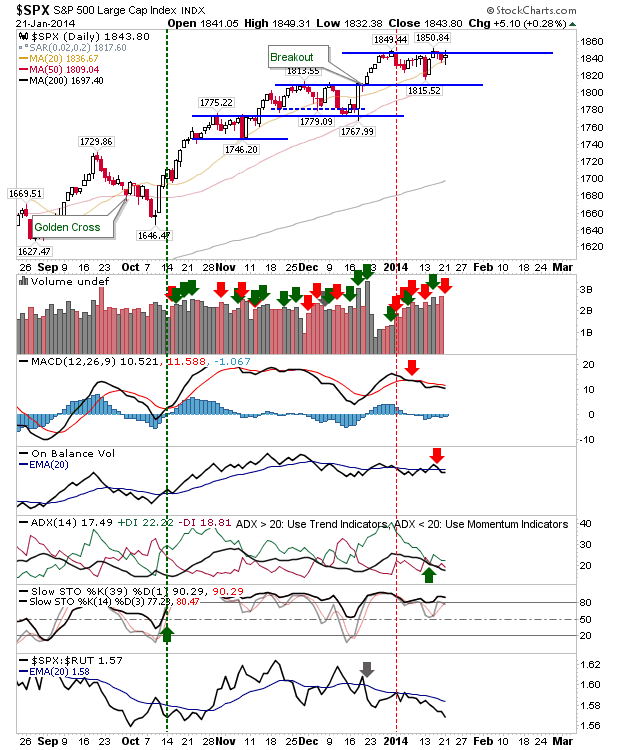

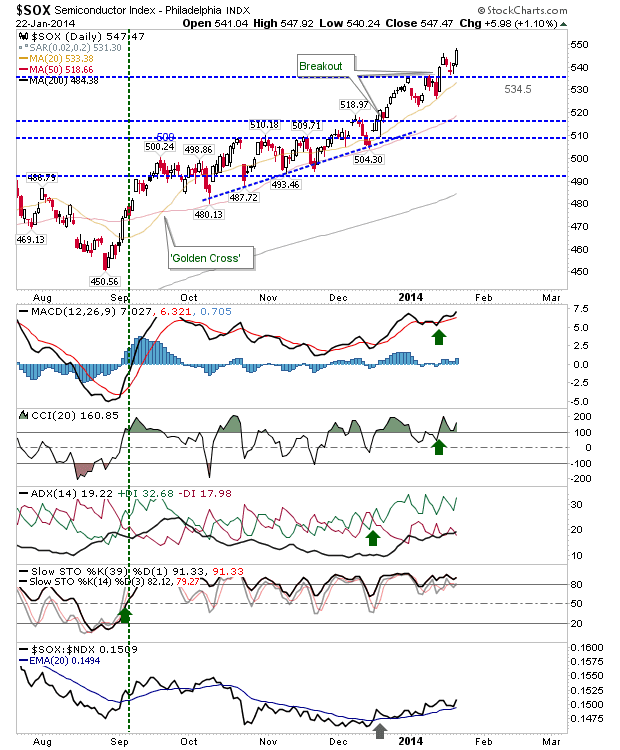

Since the New Year rolled in it has been semiconductors which have done most of the leg work for this rally: a solid 1% gain following last week's breakout is just the tonic for a technology rally: The gain in the semiconductor index was supported by technicals. Gains in the semiconductor index helped the Nasdaq 100 finish on a new high. And the Nasdaq The Russell 2000 wasn't left out with a decent gain of its own: nothing to spectacular, but enough to keep bulls interested. Only the S&P was left out in the cold. It managed a small gain, but was unable to break resistance. Play for a breakout in the S&P on Thursday. However, the Nasdaq may be set for a flat close as it hangs on to today's gains ---- All Contributions Welcome - Thank You! Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . You can read what others are saying about Zignals on Investimonials.com . JOIN ZIG