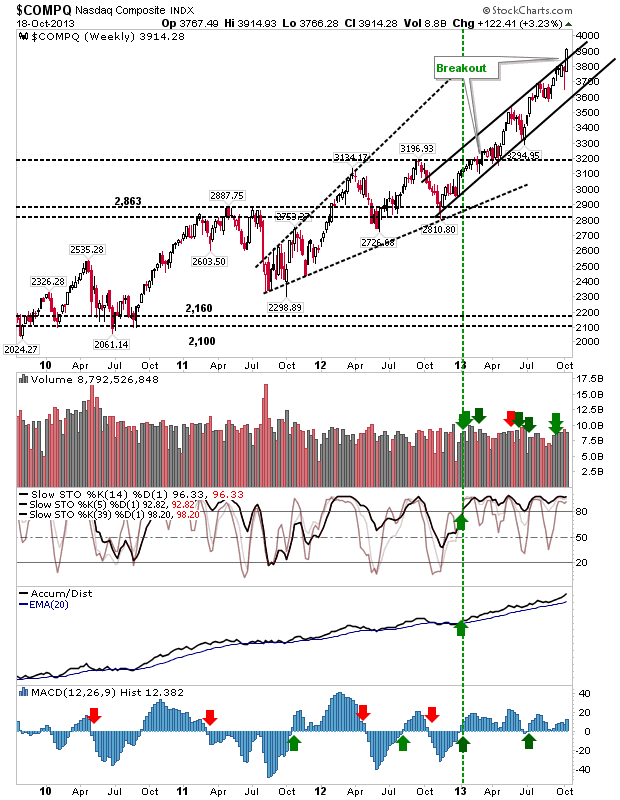

Weekly Market Commentary: Big Weekly Gain

Indices enjoyed one of their best weeks in a long time. The Nasdaq finished with over a 3% gain to leave the index with a breakout from its rising channel. Technicals remain in good shape, although there is a bearish divergence taking shape in the MACD histogram - which will catch up with the index eventually - but it will take a 'bull trap' to confirm (a drop below 3850 on the weekly chart would probably suffice).