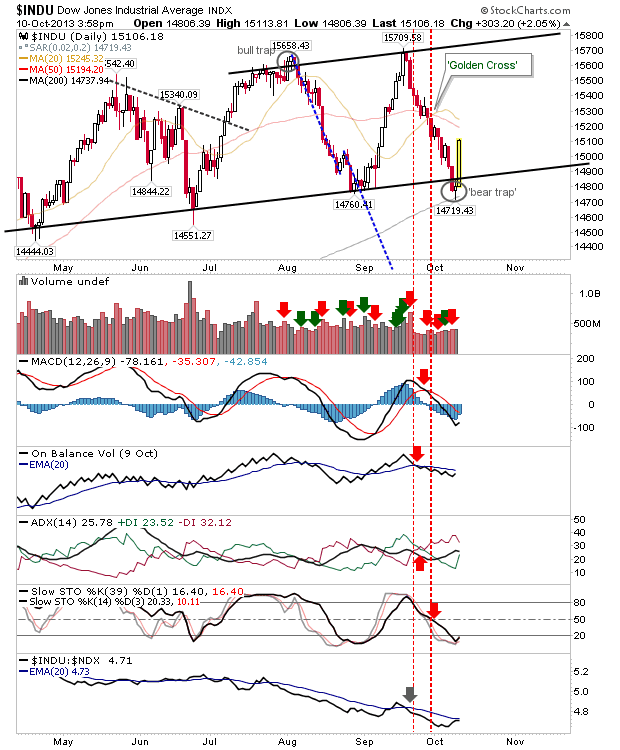

Daily Market Commentary: 'Bear Trap' Dow Jones Industrial Average

Big gains as uncertainty over the U.S. debt deal eased (although it was somewhat surprising to see so much buying). Ordinarily, one day gains as big as today's tend to be bearish over subsequent days and it will be interesting to see things play out over the next few days. The index best set to post further gains is the Dow Industrial Average. Today's gains created a 'bear trap' in the index which makes any move back to the channel a buying opportunity. Stops go on a loss of the 200-day MA or 14,720.