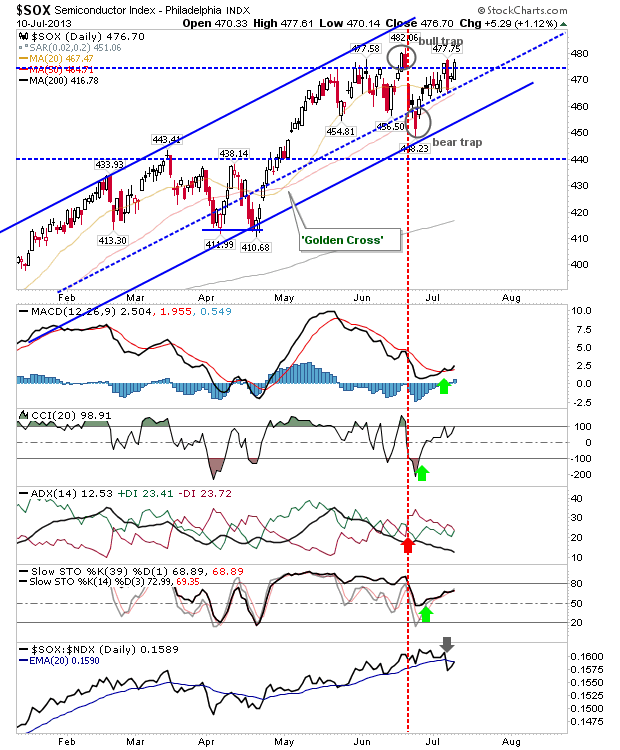

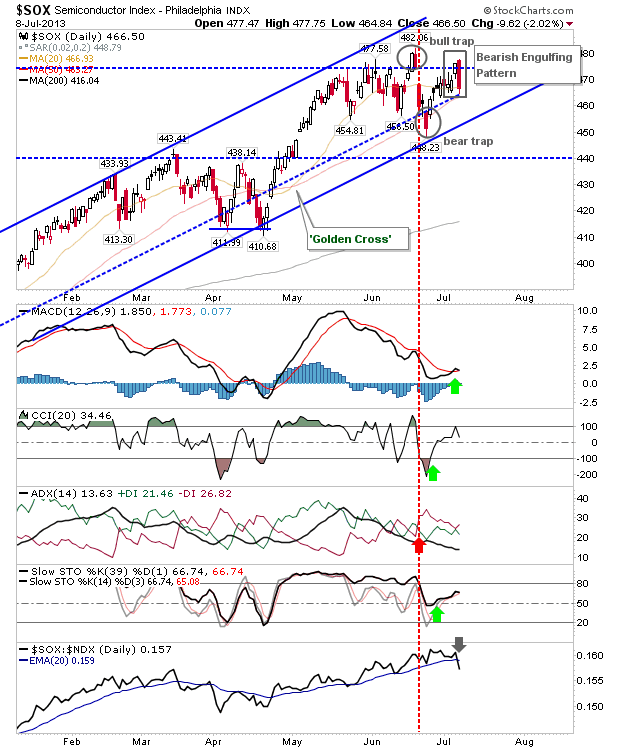

It was a modest day for the markets, with morning gaps doing most of the leg work for bulls. However, there was enough strength in the market to break the net bearish turn in technicals for many of the indices, and all key indices are back supporting the long term bullish picture, ending the May-June decline. Pullbacks can be viewed as buying opportunities It's not all plain sailing for bulls. Resistance remains in play for certain indices and the semiconductor index posted a significant bearish engulfing pattern. If you are a short, or looking to short, this is the index to watch on Tuesday.