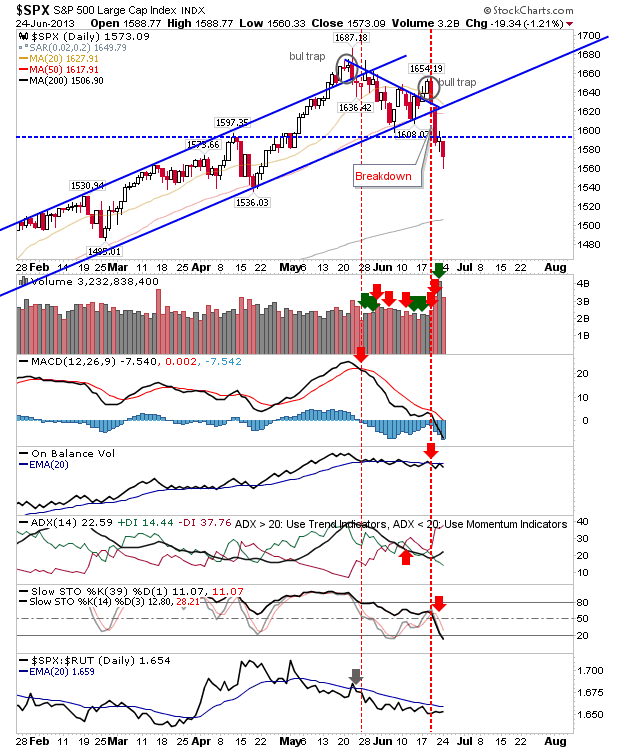

Daily Market Commentary: 20-day MAs Tested

A good day for indices saw sufficient strength for 20-day MAs to be tested. The Russell 2000 had the best of the action; it gained 1.7% to close the gap to its 20-day MA and bring the index to former declining resistance (since weakened by the 'bull trap'). However, there was a more significant relative strength change towards Small Caps and away from Large Caps and Technology - this is a more bullish development if the rally can advance past the June swing high.