Daily Market Commentary: New Highs But Not In Breadth

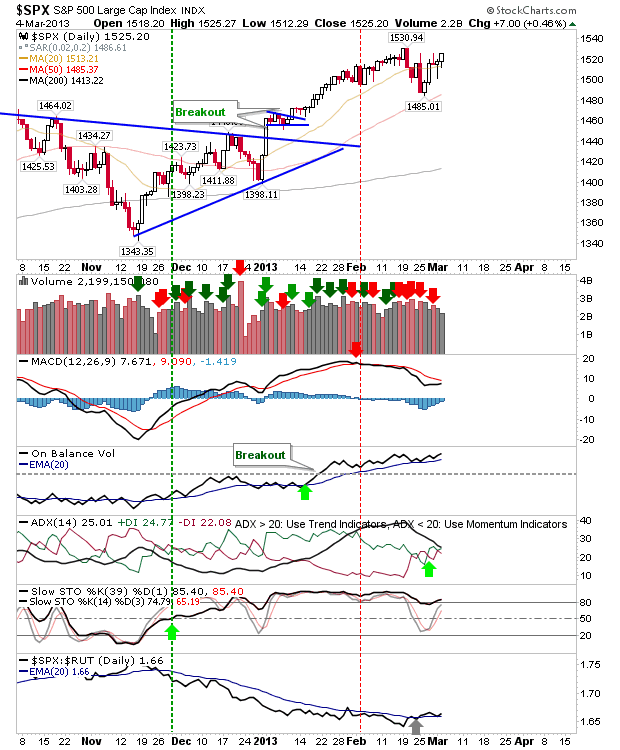

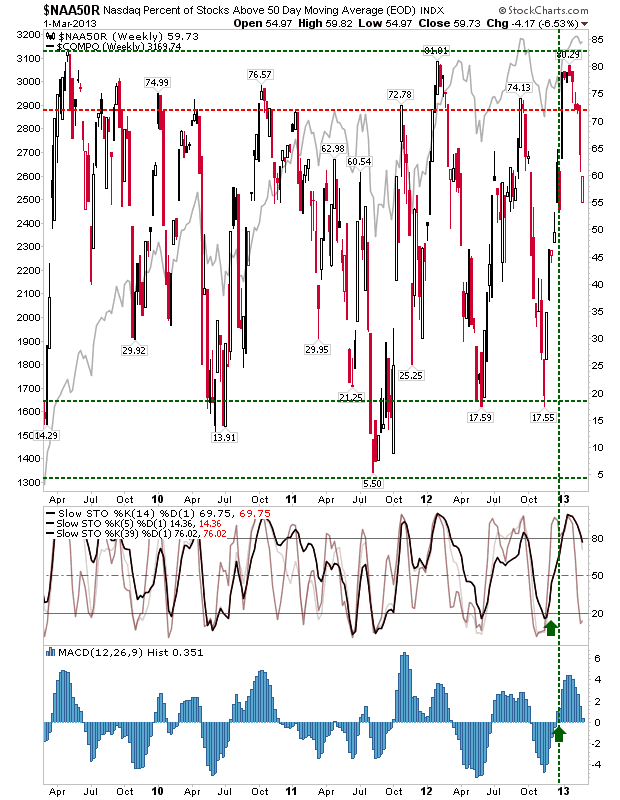

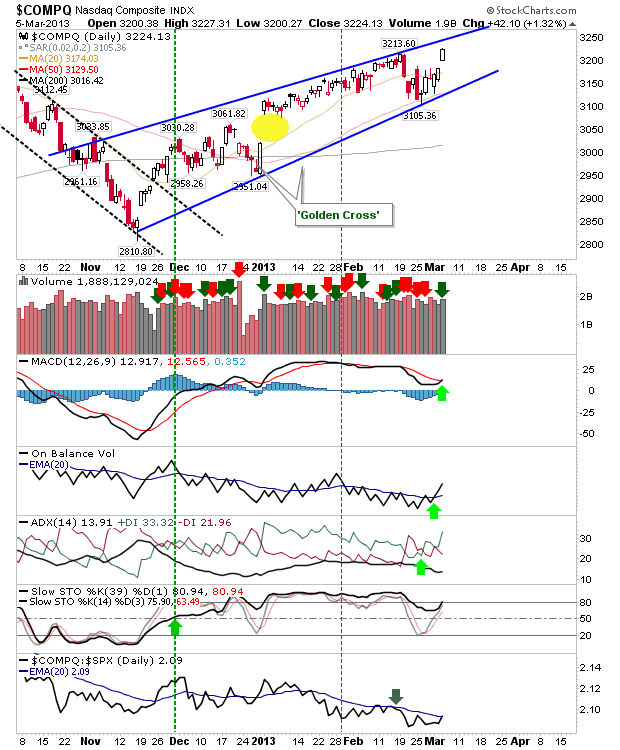

The indices grabbed the headlines , but it may be a short lived given new market highs have not been supported by breadth metrics. The Nasdaq gapped higher and was supported with a MACD trigger 'buy'. If this is a true breakout, then the gap can't close; infractions into the space suggest weakness and will run the risk of a rapid move back to its 200-day MA (effectively, a false breakout) to the extent it would be a more attractive short play than a pullback buy. Until then, caution advised for bulls.