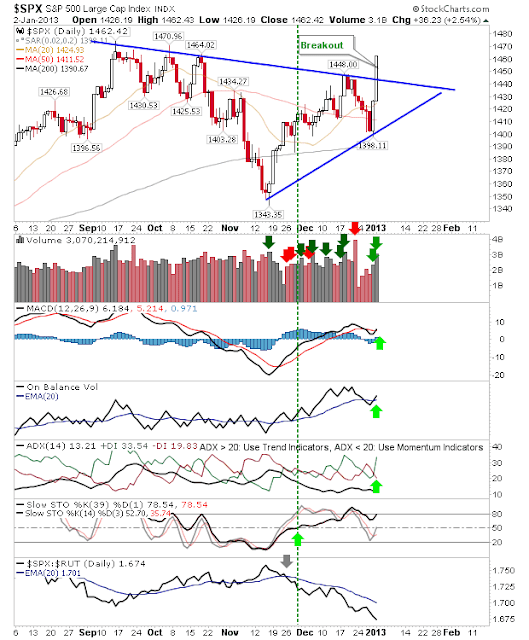

A second big day of buying pushed markets well beyond resistance, but left markets exposed in the short term. Traders looking for a sustainable rally would ideally like to see some low key action which held close to yesterday's highs. Technicals sharply improved, and any developing weakness from last week was reversed.

The S&P pushed the boundaries of its consolidation on a fresh MACD trigger 'buy'. However, larger gains in the Russell 2000 further diverged the relative relationship between Small and Large Caps; but this spreading relationship is net bullish for the market as a whole (because more money is flowing into speculative versus defensive stocks).

The Russell 2000 broke clear of the September swing high in very bullish action. The rising trend is nicely aligned with the fastest moving average (20-day MA) above the next fastest (50-day MA) and long term moving average (200-day MA); all of which are rising. Small Caps are also showing their leadership against Tech stocks. Very strong action from this index.

The only index caught in a bit of a conundrum is the Nasdaq. It's outperforming the S&P (bullish), but is caught in a bit of a No-Mans land with key supply at 3,200. It lacks the clear drive enjoyed by the Russell 2000.

Today will probably see some hangover style trading. It will be hard for bulls to get enthusiastic given the extent of gains over the past couple of days, but shorts won't want to commit in case they get a repeat in the days ahead. The first hour of trading will probably set the tone for the rest of the day.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!