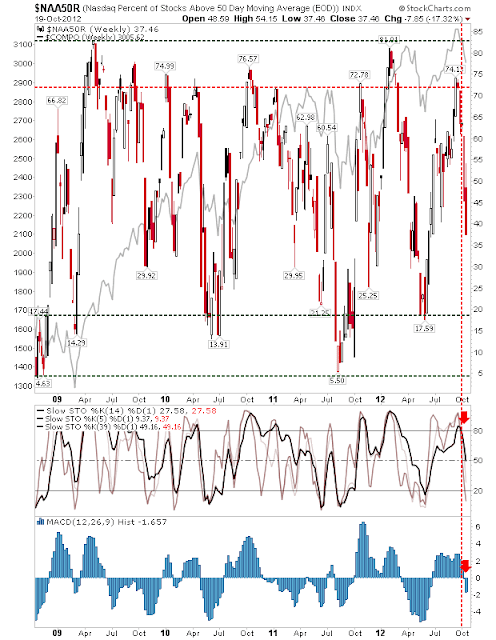

Weekly Market Commentary: Breadth Not Oversold

The last few weeks have seen sharp losses in market breadth strength. The week past was no exception, although losses weren't as great as others in recent weeks. Breadth indices have still to reach oversold conditions, which would suggest a tradable swing low, so look for downside to continue. The Percentage of Nasdaq Stocks above the 50-day MA finished the week at 34%, but is perhaps two weeks away from turning oversold. Any rally from this point is likely to be temporary. Which will only delay the development of a stronger swing low. The Nasdaq Bullish Percents saw its biggest loss since posting a swing high. Technicals are middling, but it never reached overbough conditions, despite a decent rally from April's 2012 bottom. The MACD histogram is on the verge of a 'sell' signal, so further downside is favoured. The Nasdaq Summation Index is the smoothest of the three breadth indices I track. Last week saw sharp losses as it cut below zero. Like the Bull