Daily Market Commentary: Slow Day

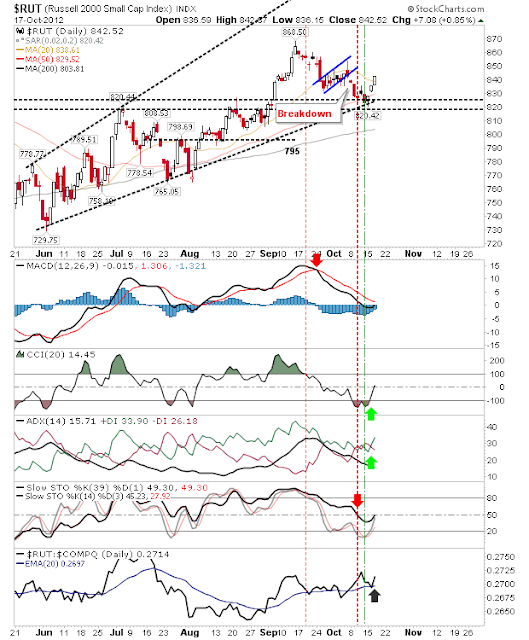

Not surprising to see markets lower on day, but surprised to see significantly higher volume to get with it. Strong consolidations in the early phase of a rally should come with lower volume. This is because the weak hands should have already sold on the way down. The S&P closed modestly lower, but there was no great change to the chart besides that. The Nasdaq suffered the most, losing 1% on heavier volume. The timing was also unfortunate, with converged 20-day and 50-day MAs acting as resistance. The Russell 2000 also sold off, but the selling came from above its 20-day and 50-day MAs, neither of which were breached. Tomorrow may see a test of the swing low. The resolve of the bulls is likely to be tested as the three day rally comes under pressure. It will be important these lows aren't violated, as they are tied to key support. --- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I