Weekly Market Commentary: Indices Finish Near Week Highs

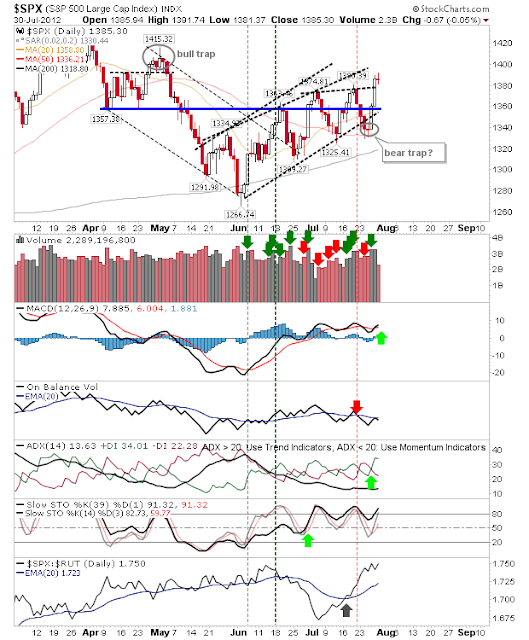

Friday's rally managed to reclaim the losses from the first part of the week, but the rally didn't clear resistance. Ironically, breadth weakened despite gains in parent indices. The Percentage of Nasdaq Stocks above their 50-day MA drifted down to 52% and is just about holding bullish territory. Technicals are net bullish. The Nasdaq Bullish Percents finished with a small loss and haven't changed much since the Nasdaq swing low of June. Technicals remain firmly in the net bearish camp. Nasdaq Summation Index was also lower. But technicals just about hold bullish territory. While breadth weakened, the Nasdaq kept above 2,890 support. How long it can do so with breadth weakening remains to be seen. The S&P continued to hug former channel support turned resistance as it eats into its bull trap. Volume was down on last week which may say more about quiet summer trading rather than general disinterest on the part of buyers. The Russel 2000 rema