Weekly Market Commentary: Comprehensive Breadth Recovery

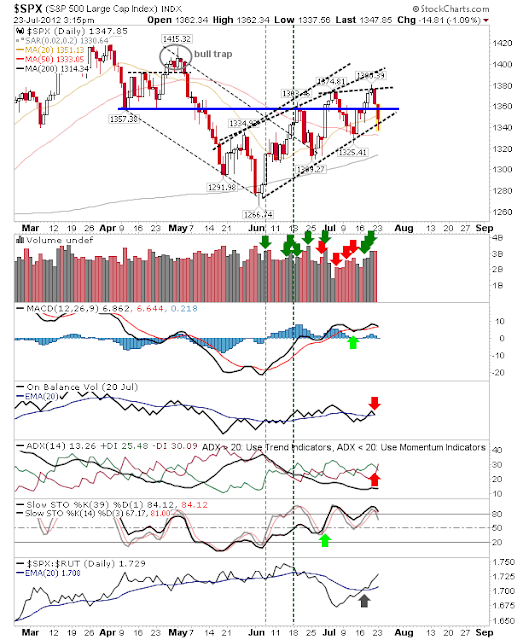

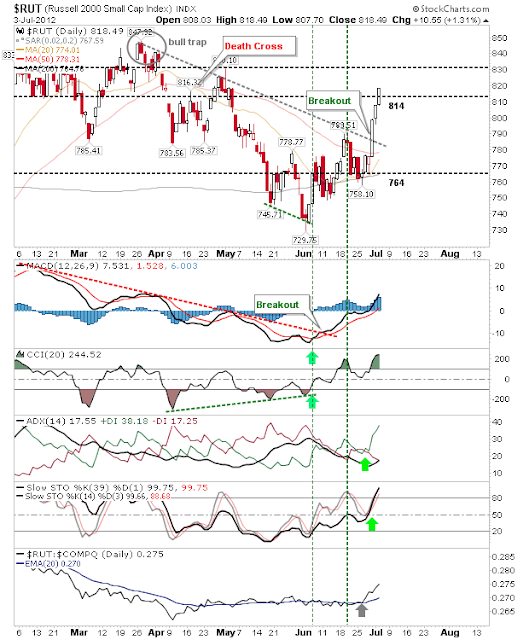

Market Breadth continued its improvement on the weekly time frame. The April low is playing out as a major swing low for breadth and the rally from this low still looks to offer further upside. The Percentage of Nasdaq Stocks Above the 50-day MA is net bullish (technically) with 59% of Nasdaq stocks above their 50-day MA. Plenty of room for upside. The Nasdaq Bullish Percents had a more low key week. Technicals for this instrument are still net bearish. The April low hasn't followed through yet. While the Nasdaq Summation Index bucked the trend by closing down last week, although the April swing low is clear and technicals are net bullish. The improvement in Nasdaq breadth has nicely shaped the parent index. There is a clear 'handle' forming above 2,885 with the spike lows into 2,800 over the past few weeks indicating demand. Below this is a good place for stops on long positions. Technicals net bearish but improving. The S&P had an interest