Daily Market Commentary: Friday's Losses Negated

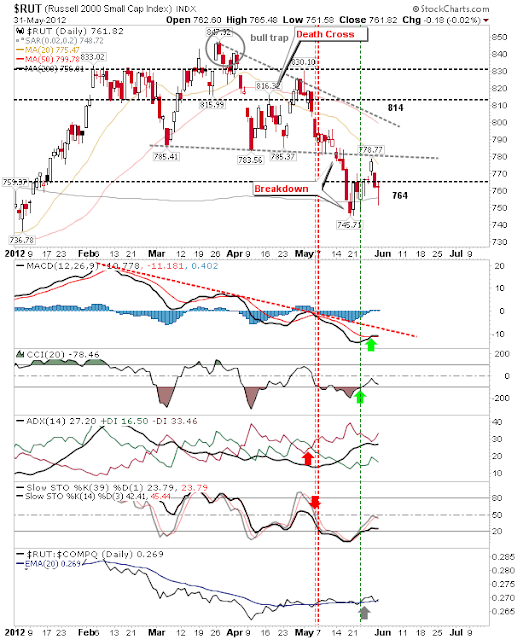

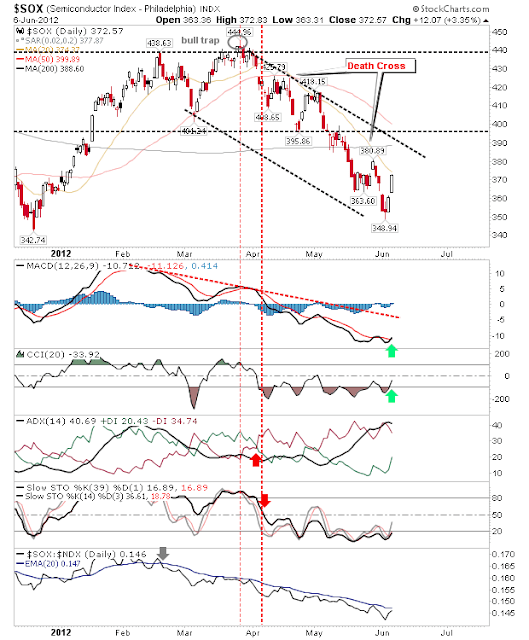

It was an odd day for bulls. All the key indices enjoyed big gains, posting returns of over 2%, but there was very little buying of speculative stocks with buyers preferring to focus on financials like Bank of America and Morgan Stanley. The biggest winner was the semiconductor index with its 3%+ gain. The index rallied right up to its 20-day MA and gained enough to see a MACD trigger 'buy'. There was a gain in relative strength against the Nasdaq, but not enough to see a net bullish shift towards semiconductor stocks. Watch for a consolidation around the 20-day MA before a secondary push to channel resistance. The S&P also rallied to its 20-day MA with a bull cross in On-Balance-Volume, but not enough to see a bull cross in its MACD. There was also a relative shift loss to Small Caps (Russell 2000), which in itself is bullish for the market as a whole, even if it hurts the S&P. The Russell 2000 had rallied back above its 200-day MA (and also to its 20-d