Daily Market Commentary: Rally Ticks Along

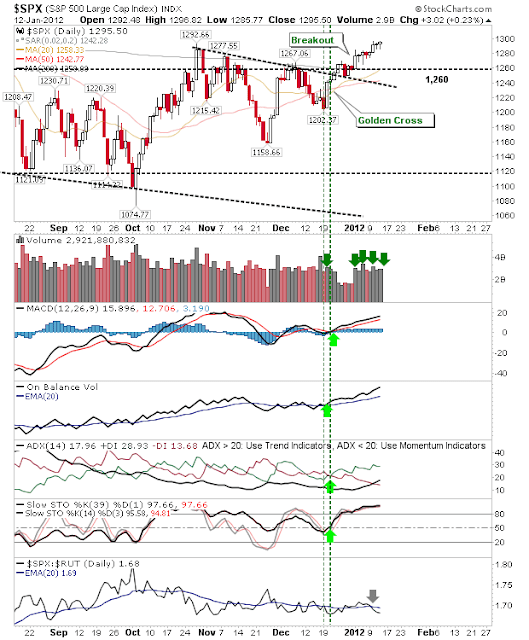

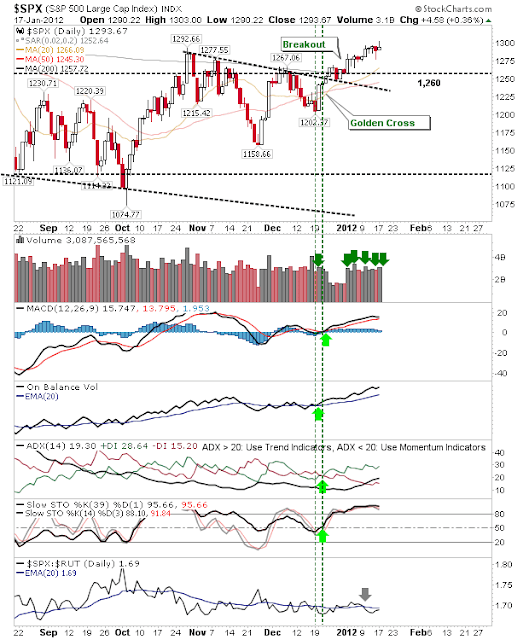

A little disappointing markets weren't able to push on after a strong start, but many indices registered accumulation days. The S&P finished near its October swing high, although it's in the process of turning this former resistance level into support. While stochastics are overbought, On-Balance-Volume and MACD continue to trend higher on the side of bulls. The Nasdaq retained some of its morning gap, but it's the shift in relative strength towards this index (from Large Caps / S&P) which is the most positive. Perhaps this rally is only just beginning? While the Nasdaq attracts interest from buyers, the Russell 2000 is losing some of its love (to the Nasdaq). However, the swing high breakout holds. The index to watch tomorrow is the semiconductor index. With the Nasdaq performing well it will be important it can draw on strength in semiconductors. At the moment, the index is struggling at its 200-day MA. The rally keeps on moving higher until