Weekly Market Commentary: Dow and Russell 2000 Pressures Resistance

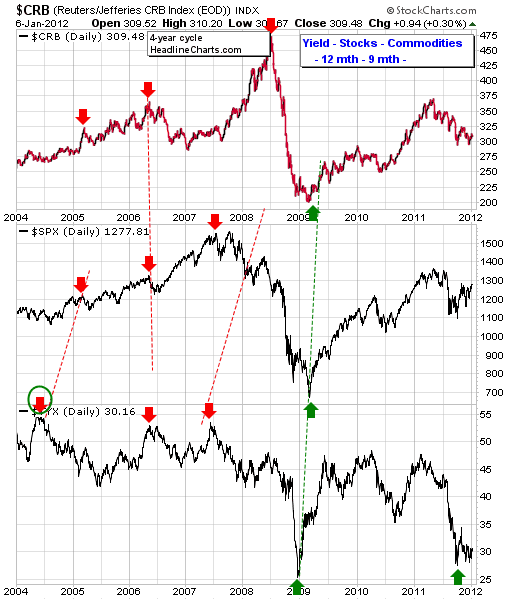

I was digging through some old charts and came across this one (originally sourced from the now defunct headlinecharts.com); what it shows is the ordered relationship between yield (bonds), stocks and commodities. When markets make a bottom or top, first to change is Yields, then Stocks, and finally Commodities. In the 4-year business cycle, there is around a 12-month gap between a turn in Yield and Stocks, and around 9-months between Stocks and Commodities. Yields in 30-year treasuries are fast approaching the swing low in 2008 - a potential support level. Stocks are already in rally mode, but assuming we are still waiting for a bottom in yields then the true bottom in Stocks may be a year away. Commodities are still in decline, but calling a bottom will first require a confirmed low in Yields and a strong case for a bottom in Stocks. For now, keep an eye on the 30-year treasuries for a bottom.

As for the indices, the Russell 2000 is mounting a fresh challenge on 760 resistance within its rising channel. The story hasn't changed for the past couple of months, although pressure on resistance has been intensifying - suggesting a run to the former head-and-shoulder neckline c780 is not far off.

The Dow during the week managed to break resistance, but by Friday had finished bang on resistance. While the Dow is not the most inspiring of indices to be leading a bull market rally, it is at least trying...

The S&P hasn't quite repeated the feat of the Dow.

While the Nasdaq is stuck in no-mans land. Look to the Dow and Russell 2000 for leads in this regard.

The coming week should be the one resistance breaks for both the Dow and Russell 2000. Bulls have the edge, the question is whether they can capitalize on it?

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

As for the indices, the Russell 2000 is mounting a fresh challenge on 760 resistance within its rising channel. The story hasn't changed for the past couple of months, although pressure on resistance has been intensifying - suggesting a run to the former head-and-shoulder neckline c780 is not far off.

The Dow during the week managed to break resistance, but by Friday had finished bang on resistance. While the Dow is not the most inspiring of indices to be leading a bull market rally, it is at least trying...

The S&P hasn't quite repeated the feat of the Dow.

While the Nasdaq is stuck in no-mans land. Look to the Dow and Russell 2000 for leads in this regard.

The coming week should be the one resistance breaks for both the Dow and Russell 2000. Bulls have the edge, the question is whether they can capitalize on it?

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!