Daily Market Commentary: Quiet Day

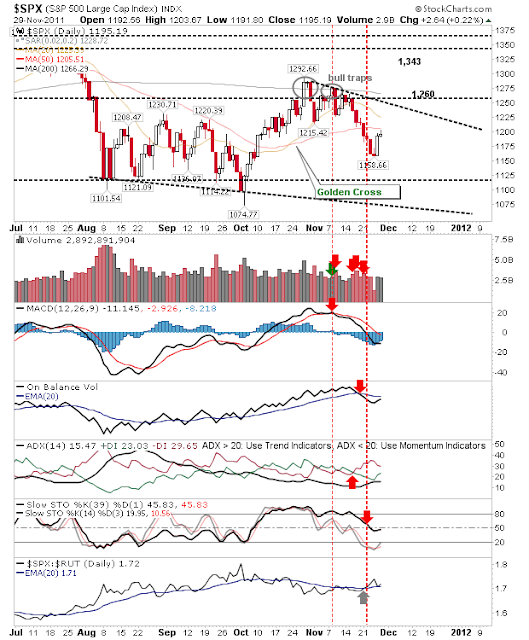

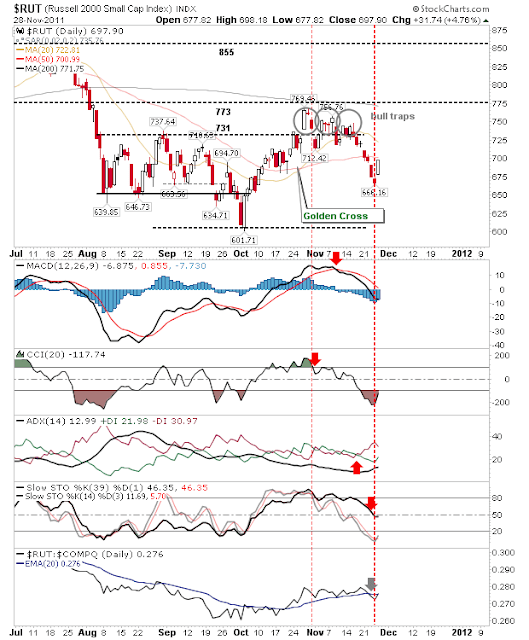

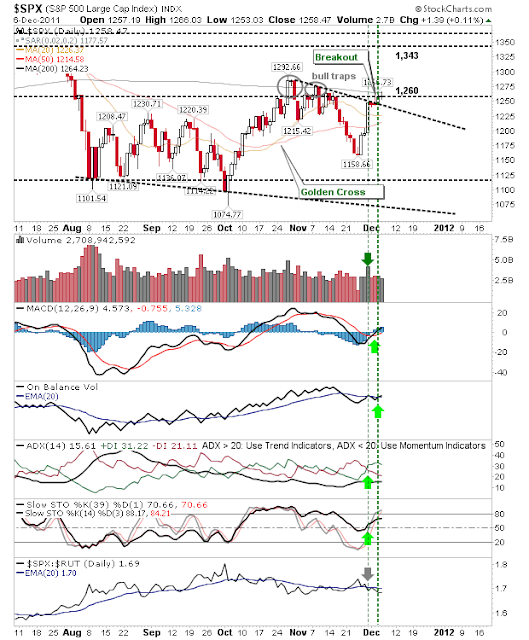

There is very little to say about today that wasn't covered yesterday. Markets were unchanged - in fact, today's narrow range may be used to enter a trade on a break of the day's high/low with a stop on the flip side. The presence of 200-day MA resistance probably gives the edge to bears - but there are 'Buts' The S&P is a case of mixed emotion; 200-day MA resistance, but a bullish breakout from declining resistance. Technicals are bullish for lead indices And market breadth continues to improve So if 200-day MAs are broken to the upside it may offer grounds for another decent step up for this rally. -------- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-Wo