Daily Market Commentary: Strongest Market Experiences Weakest Volume

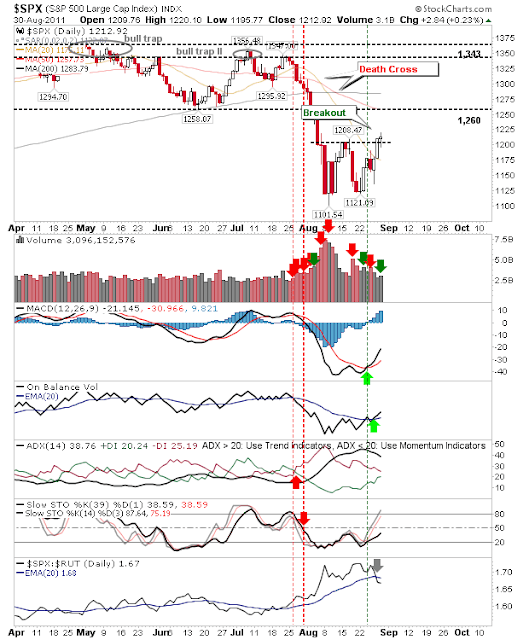

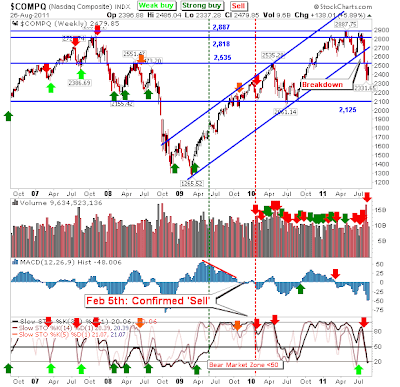

Today held similarities to the past couple of days; small gains on heavier volume. However, one index bucked the trend. The Nasdaq 100 is the first to test supply at the 50-day MA, but it was also the only index not to experience confirmed accumulation. This weakness may come back to haunt it if buyers run to the safety of Large Cap stocks. Nasdaq 100 Index ($NDX) via StockCharts.com The S&P still has some way to go to achieve the success of the Nasdaq 100 and despite enjoying an accumulation day it was unable to hold its early morning gain. The Nasdaq was caught in the middle. It made its initial test of 2,616 resistance, but on higher volume accumulation. Nasdaq Composite ($COMPQ) via StockCharts.com Finally, the Russell 2000 finished slightly down on the day, although it's breakout held. The issue for tomorrow is whether some of the late day uncertainty builds into a more concerted sell off. How will market breakouts hold when the selling does start? T