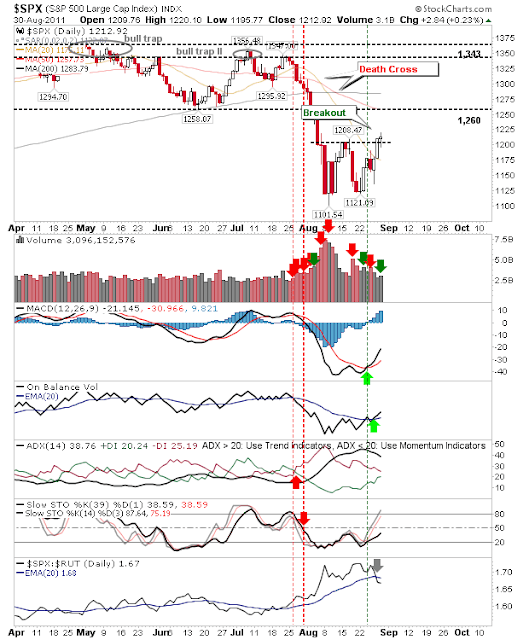

Yesterday's gains produced fine line breakouts which would have been easy to reverse on slight losses. But markets retained gains and Tech indices were able to put some distance from support, enough to offer some downside protection.

The S&P was relatively quiet as buying focused around Tech and Small Caps. The S&P finished the day with a small gain on higher volume accumulation. Yesterday's breakout remaining valid.

The Nasdaq had the benefit of higher volume accumulation and a 0.5% gain. The index will soon be running into its first real test at 2,616 resistance.

The Nasdaq 100 took the gains a step further, surpassing the trading range low and approaching the 50-day MA. Given the index had no problem regaining the trading range it's likely the Nasdaq will push above 2,616. How these indices perform at the 50-day MAs is the real question.

Driving gains in the Nasdaq and Nasdaq 100 is the semiconductor index. Semiconductors gapped out of the narrow channel and are moving towards the 50-day MA.

One of the worries for this rally is the lack of

breakout candidates. However, with markets shaping a double bottom there should be enough momentum to see challenges on 50-day MAs. Look for shorts to turn up the heat when this key intermediate term trend metric is tested.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!