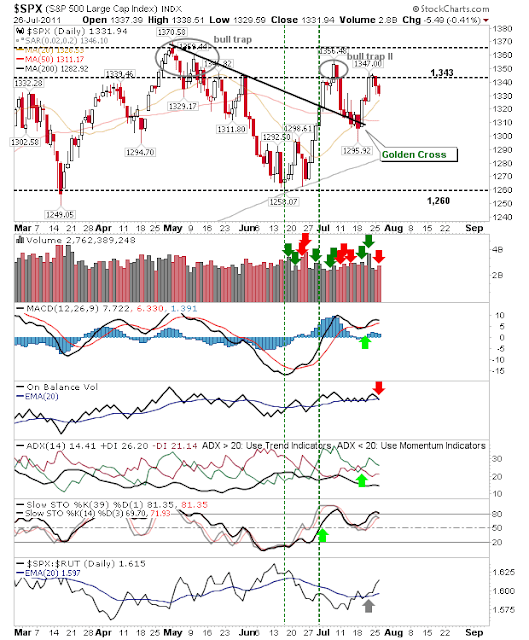

Daily Market Commentary: Close at High

After the late morning drop it was going to be hard to get the 'bear traps' bulls were looking for. Although some markets performed better than others. The S&P finished right on the cusp of the 'bear trap' marker, although it did well to make up the 25 points it lost during the day. Volume climbed to register an accumulation day. There is still a good chance it will confirm the 'bear trap' tomorrow. ($SPX) via StockCharts.com The Nasdaq was more traditional in it found demand just before it touched on 2,616 support. Watch for supply as it makes a second pass on its 200-day MA. ($COMPQ) via StockCharts.com The Nasdaq 100 had the strongest day and it was the index best positioned for support. It comfortably held its 200-day MA (in the end) and fell just shy of closing above its 50-day MA. Technicals are still net bullish and has the least amount of overhead supply to consume. ($NDX) via StockCharts.com The semiconductor index posted over a 1