Weekly Review of Stockcharters: Markets Defy Opinion

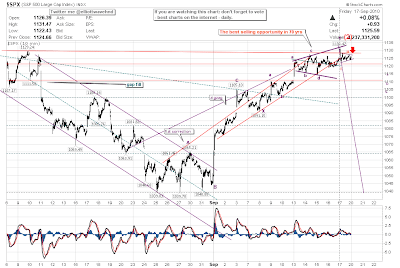

Friday's flourish gave the week a bullish filip. What had the Stockchart.comers have to say about it. Anthony D Allyn of Elliotwavehound.blogspot.com offers his outlook: I'm a seller of this market. We are way over-bought here. It's only left over emotional energy from wave E/2 holding this market up now, so It's best to head for the exits before wave 3 starts. The easy money is finally about to be made on the short side, and no amount of manipulation can prevent it. The media campaign... to change investor sentiment has failed miserably. Will this double top (on the 10-minute) come to fruition? Monday's the day... Friday's gains were viewed as a throw-over. Richard Lehman of the Channelist had said, before Friday, this: 9/23 -- Looks as if the broad market is finally rolling over, but cannot quite draw new downchannels yet. Hopefully will have enough data to draw minichannels on Friday. 9/21 -- Today's lift made things verrrrrry toppy. T