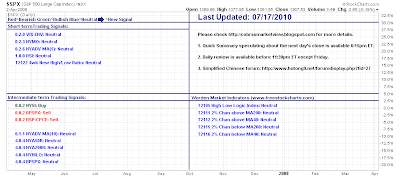

Daily Market Commentary: Breakout Part II

First there was the break of the April-July channel, then there was a new down channel marked from June-July, now there is an upside break of the June-July channel. Whether the modest breakout for the S&P marks another shift back towards bulls - today was significant in reversing a picture perfect rebuttal at channel resistance. Thursday's was also enough to reverse a 'sell' cross between the +DI and -DI. ($SPX) via StockCharts.com " The Nasdaq also crept out of its major April-July channel but the concern is the proximity of the 200-day MA directly overhead. Hard to say if this is a true breakout? Relative strength is swinging back to more speculative tech stocks from safer large caps - a bullish development - particularly when the last (bearish) signal was June 1st. ($COMPQ) via StockCharts.com Small Caps also cracked above its downward channel, although technically it's in worse shape than either tech or large cap indices. ($RUT) via StockCharts.co