Daily Market Commentary: Tech Raises Questions

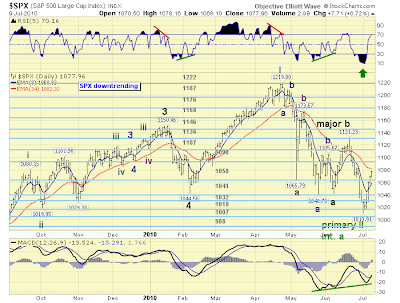

It was a tricky day for markets. On the positive side, Large Caps held their channel breakouts and are nicely positioned to build on yesterday's gains; volume eased in line with a bullish consolidation. ($SPX) via StockCharts.com On the more mixed side were the Nasdaq and Nasdaq 100, in each case there is indecision at converged 50-day and 200-day MAs but the Nasdaq is also up against declining channel resistance. Technicals of each have turned net bullish so there is momentum to drive a break. ($COMPQ) via StockCharts.com The hardest hit was the semiconductor index. After a strong day yesterday, today it finished with bearish cloud cover. Not the ideal scenario to help drive Tech averages higher. ($SOX) via StockCharts.com For Wednesday keep an eye on the Nasdaq and watch for upside follow through in the S&P and Dow. Technicals suggest there is more upside in the tank but markets remain vulnerable with the sequence of lower highs and lower lows intact. Follow Me