Weekly Market Commentary: Rally Continues

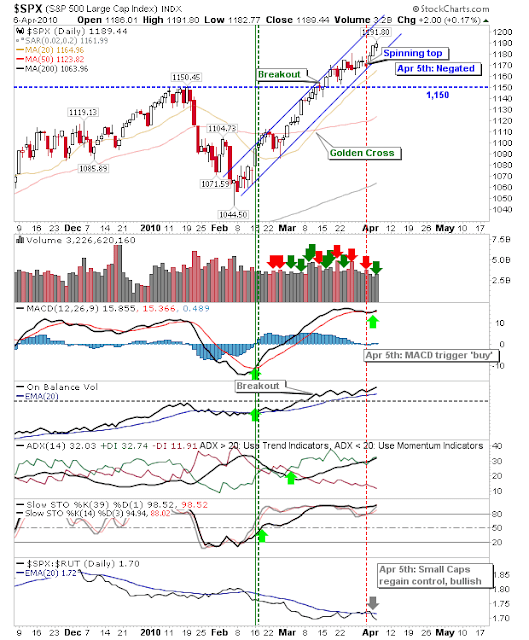

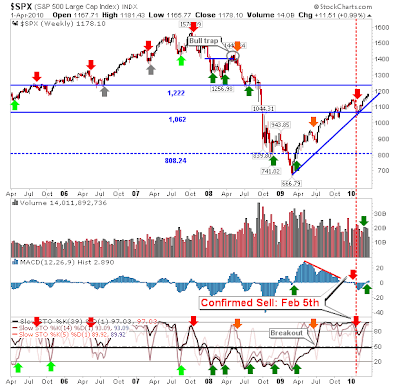

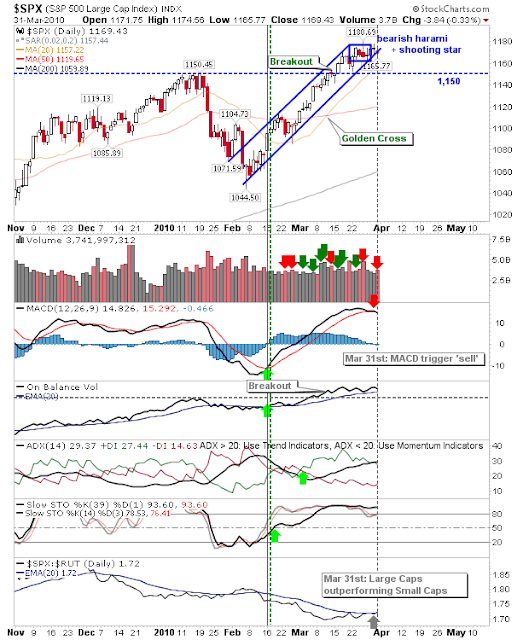

It was another week of gains which kept the 2009/10 rally chugging along. For the S&P there is still 27 points on offer before resistance becomes an issue and even then, comparable resistance as playing for Tech is around 1,400 (or 200 points away). $SPX via StockCharts.com For the Nasdaq it was an opportunity to touch the first of two reaction highs from 2008; it's hard to believe stocks are offering valuations based on pre-bank-fail prices??? The February 5th 'Sell' trigger holds Nasdaq via StockCharts.com The Nasdaq 100 did more by breaking past the lower of the two 2008 reaction highs, bringing the earlier 2008 reaction high around 2,022 into play. Can it reach the latter price? Nasdaq 100 via StockCharts.com Will the Bulltrap 'Buy' come true? Bullish Percents only a few points from prior high of 75% Nasdaq Composite Bullish Percent Index via StockCharts.com Nasdaq Percentage of Stocks Above 50-day MA fast approaching resistance Nasdaq Percent of S