Stock Market Commentary: End-of-Week Gains Continue

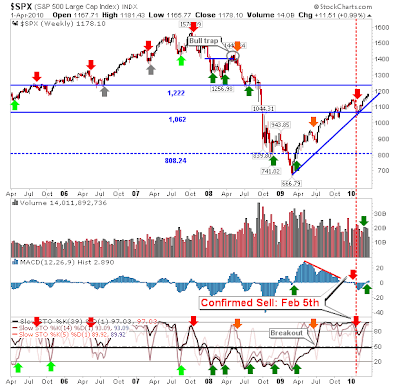

For the fifth week in a row the S&P closed the week higher but volume was well down on prior weeks. There is still another 50 points or so until resistance is reached and at its current rate it will take another 5 weeks to get there! Stochastics [39,1] are bumping along near max values with an earlier MACD trigger 'buy' still holding.

The Nasdaq 100 has already made it to 2008 reaction high resistance with the Nasdaq not far off:

The weekly Summation Index may have peaked after posting a loss as the parent Nasdaq gained on the week.

And the Percentage of S&P Stocks above the 50-day MA reached 91.4% - although the high of 93% in 2009 didn't do more than a signal a brief paused in the advance.

So while the indices keep pumping higher, supporting breadth indicators are very toppish. Will we see another higher close for the week? I suspect this week will see a lower close but will it really kick start a larger decline?

Stock Breakout

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!

The Nasdaq 100 has already made it to 2008 reaction high resistance with the Nasdaq not far off:

The weekly Summation Index may have peaked after posting a loss as the parent Nasdaq gained on the week.

And the Percentage of S&P Stocks above the 50-day MA reached 91.4% - although the high of 93% in 2009 didn't do more than a signal a brief paused in the advance.

So while the indices keep pumping higher, supporting breadth indicators are very toppish. Will we see another higher close for the week? I suspect this week will see a lower close but will it really kick start a larger decline?

Stock Breakout

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!