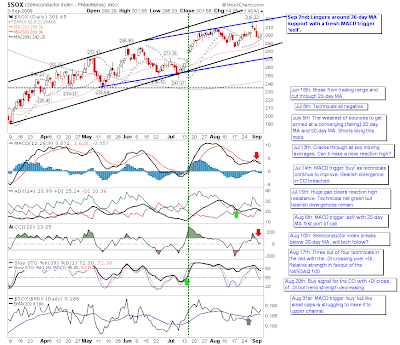

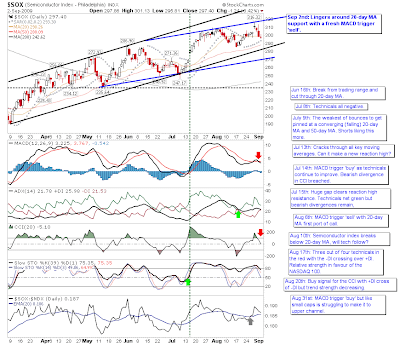

Stock Market Commentary: New Closing Highs

Much better stuff from the indices; new highs on significantly higher volume. The Nasdaq shows it best with plenty of room to channel resistance. Since July there have been 18 accumulation days and 4 distribution days for this index. MACD also looks set for a 'buy' well above the bullish zero line. The other key strong performer was the Semiconductor index. It had already secured a higher high yesterday (along with a new MACD trigger 'buy' above the bullish zero line) and looks set to break what was a potential resistance level from the bearish wedge. So much for seasonal weakness - but September isn't over yet. Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts , stock charts , watchlist, multi-currency portfolio manager and strategy builder website. Forex data available too.