Transports Duck is Broke

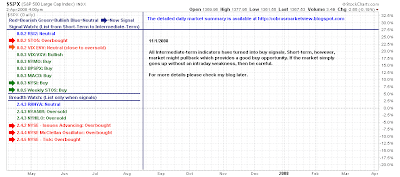

After months of techincal and price weakness we have seen the emergence of a nascent rally in the Transports. Transports will be key in the development of new market leadership given the collapse in oil prices and their role in early economic recovery. Note the break of the 3-month bearish divergence in stochastics; currently overbought in the short term. Plus the weakening of the bear trend. I have marked in Fib retracements as the watch zone on the decline. Nothing in yesterday's action suggested anything more than profit taking in the face of rare gains. But what happens as part of this decline - and where it stops - will be very important for the intermediate/long term picture. TraderMike says it best in his market summary. Thanks to Charles Kirk for the Kirkbert Bump - biggest one day traffic ever! New Visitors - please subscribe either to my feed , or my twitter feed which is routed to cover all my blog posts here, and on Zignals , in addition to links to my PDF newsletter