Sellers have control, but buyers are not giving up.

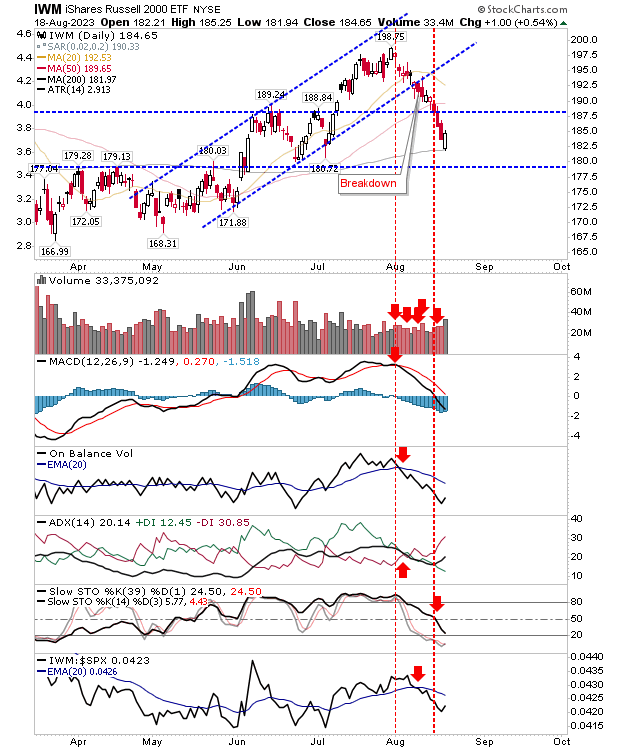

The latter part of the week saw sellers pick up the pace, but buyers were not going to give up without a fight. In the case of the Russell 2000 ($IWM), the 200-day MA has acted as a point of action for buyers. Volume rose in confirmed accumulation, although technicals remain net bearish.

The Nasdaq did manage a higher close compared to the open price, but there isn't a huge amount of support on offer. The swing low from June offers an opportunity for bulls to step in, but even then, there is a potential reversal off 13,865 that would mark a possible head-and-shoulder reversal pattern. Shorts could aggressively go short at this point, but short term traders could look to buy Friday's finish for a move to 13,865.

The S&P is also testing June lows in what, like the Nasdaq, could turn into a head-and-shoulder reversal. Technicals are net negative, although stochastics are oversold. The index is outperforming the Russell 2000, that in itself, offers itself as a buying opportunity. Longs could take a punt here, but look for a reversal at 4,450 *if* a head-and-shoulder pattern was to emerge here.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.