Bounce Struggles Following Earlier Profit Taking; 50-day MAs Hold For Now.

We had the initial phase of profit taking which took indices down to key moving averages. Yesterday saw the first attempt by buyers to recover the losses, but today's action has turned things much more bearish. Bulls seem to be a far fewer in number than Bears which only accelerated the selling.

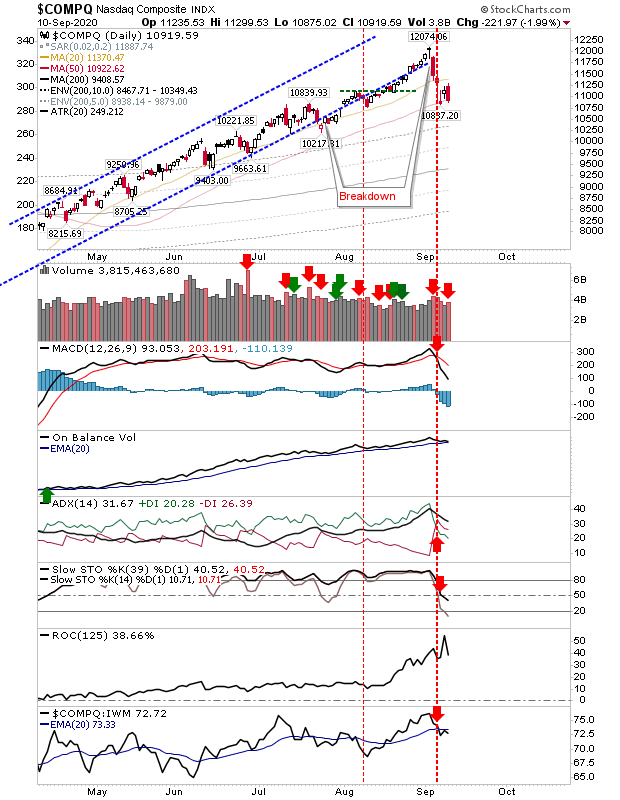

The Nasdaq is again back at its 50-day MA on higher volume distribution selling. Today's action has shifted the action net bearish in momentum, but not oversold. Only On-Balance-Volume is holding on to its prior April bullish trigger. Having only tested the 50-day MA for the first time since April just a couple of days ago, it's looking less likely it will be able to hold this moving average over the coming days. The 200-day MA is far below, so we could be looking at an ugly September until we get to this key long term moving average.

It was a similar story for the S&P. The index broke below midline stochastic support with only On-Balance-Volume still favoring accumulation. The index is above its 50-day MA haven't yet to fully test this moving average as happened for the Nasdaq. It got somewhat lucky by not experiencing net distribution.You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.