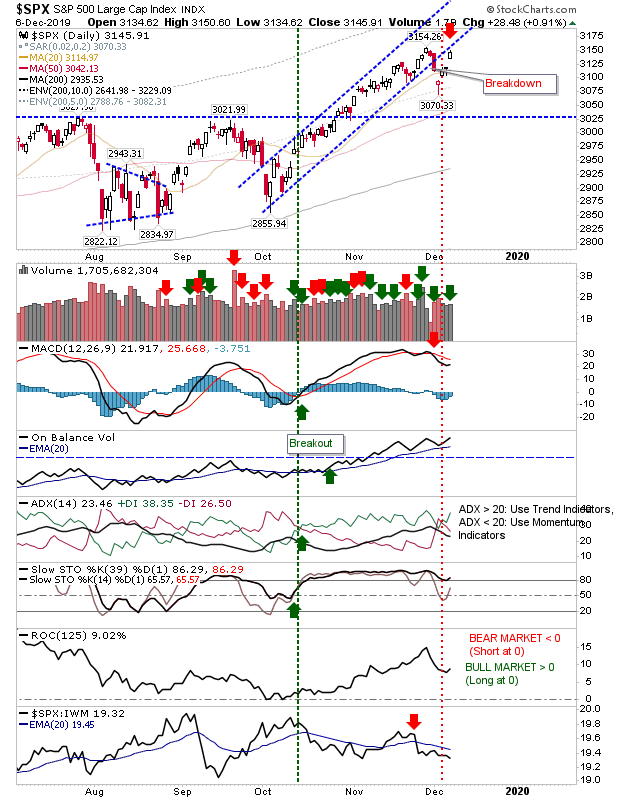

Relief Rallies Face Challenges From Former Channels

After the channel breakdowns last week indices now face the prospect of challenging former support of these channels. Shorts may try and force the issue although any gains would be enough to see new multi-year highs and likely return many of these indices inside these channels.

The S&P did register a bullish accumulation day as part of its channel challenge. Shorts will take comfort from the maintained MACD 'sell' trigger and continued relative underperformance against the Russell 2000 (although this is bullish for the broader market).

The Nasdaq is also nested against channel resistance after edging an accumulation day. The index is strongly outperforming the S&P so it may be harder for shorts to influence although it too has a MACD trigger 'sell' to negotiate.

The index which is resting in relative comfort is the Russell 2000; there is no channel pressure and the index nosed into new all-time highs. The Russell 2000 is outperforming peer indices which gives bulls something to work with.

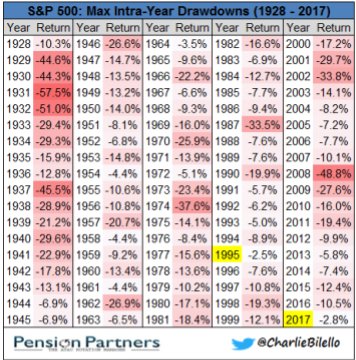

Seasonal factors favor bulls so if buyers can push indices to new highs then it will kill likely the last opportunity for shorts to make an impression before the year is out.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The S&P did register a bullish accumulation day as part of its channel challenge. Shorts will take comfort from the maintained MACD 'sell' trigger and continued relative underperformance against the Russell 2000 (although this is bullish for the broader market).

The Nasdaq is also nested against channel resistance after edging an accumulation day. The index is strongly outperforming the S&P so it may be harder for shorts to influence although it too has a MACD trigger 'sell' to negotiate.

The index which is resting in relative comfort is the Russell 2000; there is no channel pressure and the index nosed into new all-time highs. The Russell 2000 is outperforming peer indices which gives bulls something to work with.

Seasonal factors favor bulls so if buyers can push indices to new highs then it will kill likely the last opportunity for shorts to make an impression before the year is out.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.