Trump's Russian shenanigans didn't move the market as much as such actions in the past may have done but not all markets escaped such interest.

The Russell 2000 took the brunt of Friday's selling. The 'bear flag' off former support, now resistance, followed through lower to bring the index back to a flat-lined 50-day MA. Technicals are mixed with 'sell' triggers in the MACD and +DI/-DI. Relative performance accelerated lower after months of underperformance. Small Caps are key bull market leaders but there has been a distinct lack of interest from buyers for the last 6 months and this is not good news for other markets.

Weakness in Small Caps has started to sow doubts in other indices including a potential 'bull trap' in the S&P. The point loss in the index was small so it won't take much to revive the rally, but the index will need a kicker if Small Cap weakness is not to play a larger role in Large Cap performance.

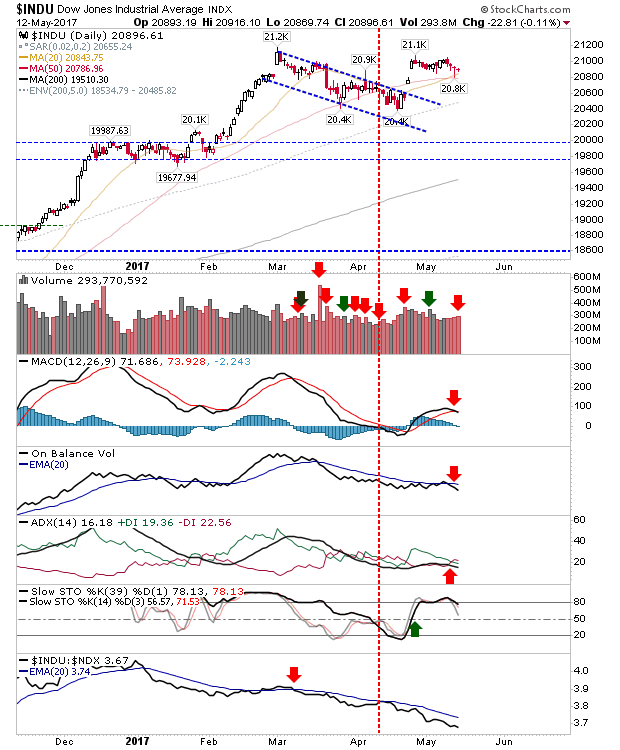

The Dow Jones is similarly encumbered. Note the positive test of converged 20-day and 50-day MAs on higher volume distribution. Monday will be important.

If there is a bright spot it's the Nasdaq and Nasdaq 100. Both indices are feeding off the recovery in Semiconductors. The latter index posted good gains from a 'bear trap' with technicals bullish. Last week's breakout gap adds to the bullish momentum. An uptick in relative performance is coming off the back of a scrappy 6-months in its relationship to the Nasdaq 100; a break to new highs will be needed to confirm price action.

With the assistance of Semiconductors, Tech indices are outperforming with supporting technicals net bullish.

However, a moving average of new 52-week highs for Tech and NYSE are showing a slowdown too. This has not coincided with a pick-up in new 52-week lows, but this rally is starting to run on fumes.

For tomorrow, bulls can look to the Semiconductor Index to continue its run. However, if there is a slow start then look to the Russell 2000 to push lower and undercut its 50-day MA. This could lead to a similar loss in the Dow Jones and put further pressure on the S&P.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on

eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.