Bears Scratch The Market

It was looking good for bears, until the late recovery put a bit of a gloss on proceedings. The first half hour of trading (and premarket) will be important tomorrow.

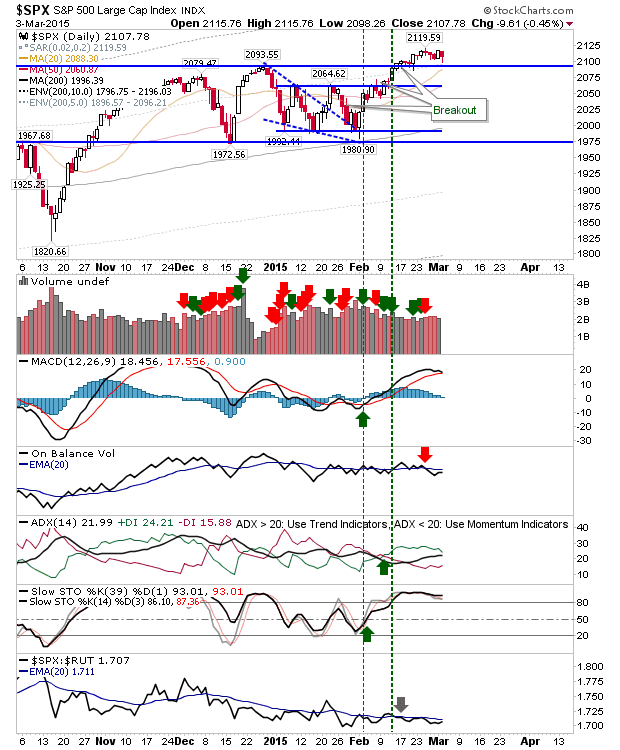

The S&P is trading close to breakout support, and the 20-day MA is fast approaching to lend a hand. If bears were able to break both these levels it would open up for some downside. Although, fresh support would quickly emerge at converged 2064 support and the 50-day MA, but beyond that there is room down to 2000/1990.

Perhaps more disappointing was the loss in the Semiconductor Index. It effectively gave back nearly all of yesterday's gains, bar the gap. There is room down to 702 support. A spike low would be the ideal bullish riposte; a strong end-of-day finish Wednesday would help shore up confidence after today.

The Nasdaq experienced selling distribution, but did enough by the close to give bulls something to work with tomorrow.

The Russell 2000 also clawed back its loses and is well protected against weakness, with the 20-day MA creeping above 1220 support.

The big picture hasn't changed much. Rallies are still in play and indices close to support, like the S&P, successfully defended such support.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P is trading close to breakout support, and the 20-day MA is fast approaching to lend a hand. If bears were able to break both these levels it would open up for some downside. Although, fresh support would quickly emerge at converged 2064 support and the 50-day MA, but beyond that there is room down to 2000/1990.

Perhaps more disappointing was the loss in the Semiconductor Index. It effectively gave back nearly all of yesterday's gains, bar the gap. There is room down to 702 support. A spike low would be the ideal bullish riposte; a strong end-of-day finish Wednesday would help shore up confidence after today.

The Nasdaq experienced selling distribution, but did enough by the close to give bulls something to work with tomorrow.

The Russell 2000 also clawed back its loses and is well protected against weakness, with the 20-day MA creeping above 1220 support.

The big picture hasn't changed much. Rallies are still in play and indices close to support, like the S&P, successfully defended such support.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!