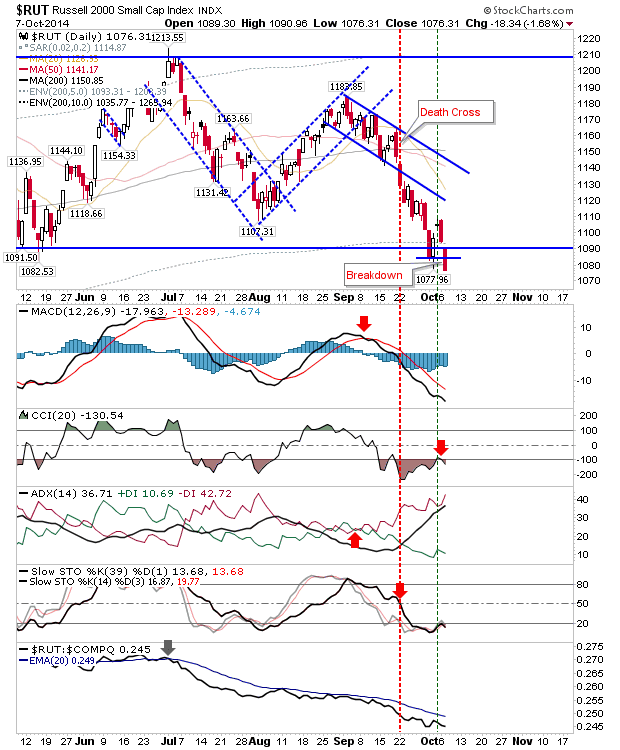

It was a day which belonged to bears from start to finish. Bulls never got a look in, and worse still, indices are now challenging the recent October lows. The real challenge is the August swing low, but the Russell 2000 has moved one step ahead with a return break of the May low and a negation of the 'bear trap'. Andrew Thrasher's

observations are even more relevant now.

The Russell 2000 negated the 'bear trap', pushing itself into a zone of minimal support. Sideline bulls will probably be wary of generating a second 'bear trap' after what happened today. This gives bears a bit of a free run. It will also drag other indices down fast.

The S&P is in a fast track to its 200-day MA. The August swing low may provide additional assistance for bulls. However, it's hard to see 1,987 tested in the near future. The potential for a bearish head-and-shoulder pattern remains.

The Nasdaq suffered heavy volume distribution and has pushed itself well into Thursday's bullish hammer. However, the index hasn't reached oversold levels on intermediate term stochastics [39,1], which in a sell off like this, would seem necessary for a trade-worthy low.

An index which may give bulls to work with on Wednesday is the Dow. It closed on a support level which isn't too far from the 200-day MA. An intraday spike low to the 200-day MA at 16,585 could also offer a good near term long-side opportunity.

Meanwhile, the Semiconductor index bounce failed.

For tomorrow, look for a relief bounces in the various indices, but these will likely be sold off as they approach resistance. The heaviest of the selling will likely come from the Russell 2000 around 1,090.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!