Well, that selling didn't last long. Buyers didn't even wait for tests of nearby moving averages before buying - they just jumped in from the open and didn't look back.

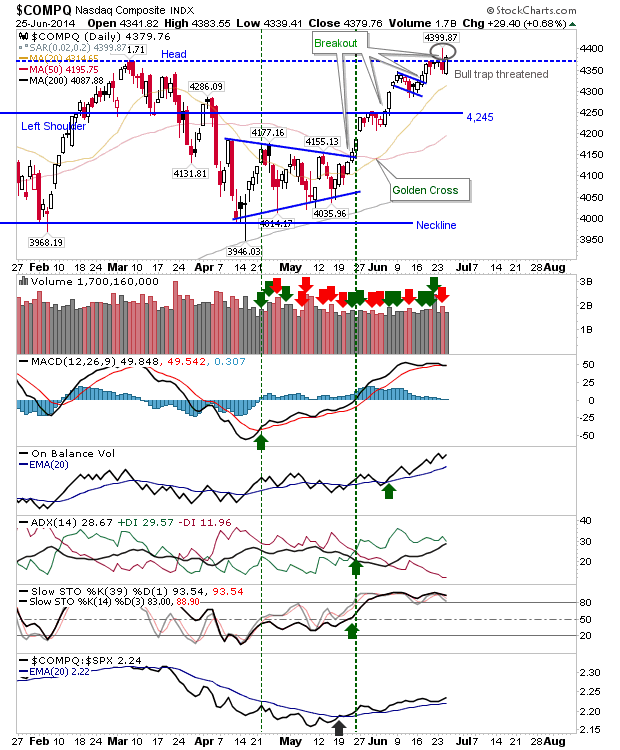

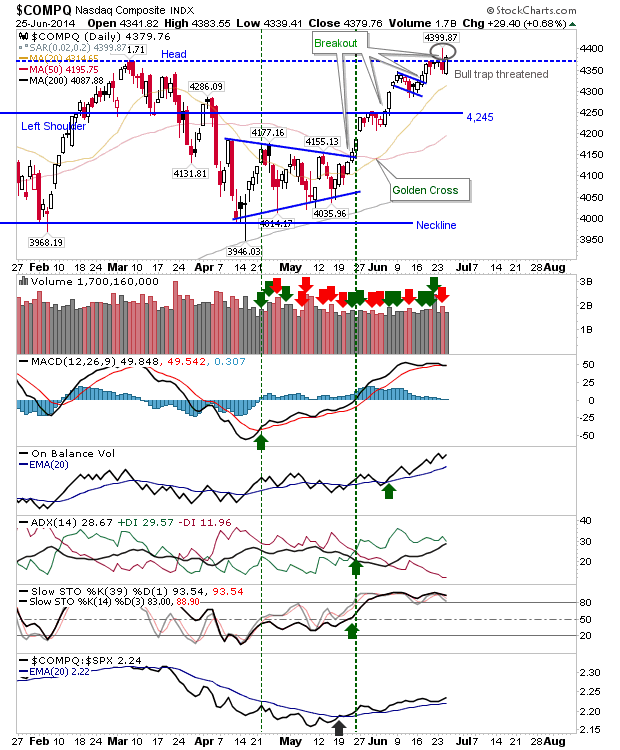

The Nasdaq may have done enough to trigger a breakout, although the spike high at 4,399 has the potential to play as resistance. Given the way the MACD is going, I suspect we are going to get a 'sell' trigger here. This is not to day bulls can't keep this going, but I think there needs to be a greater shake of weak hands from their positions to get a break of 4,400 to hold.

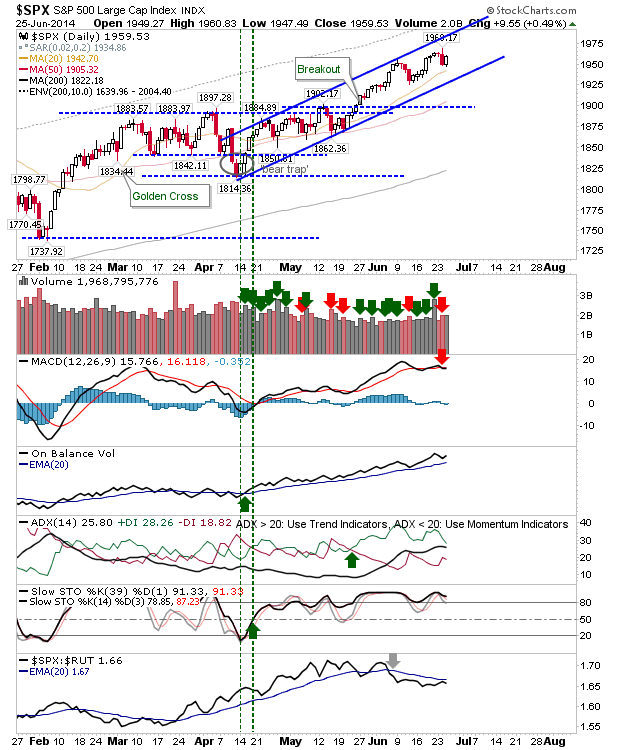

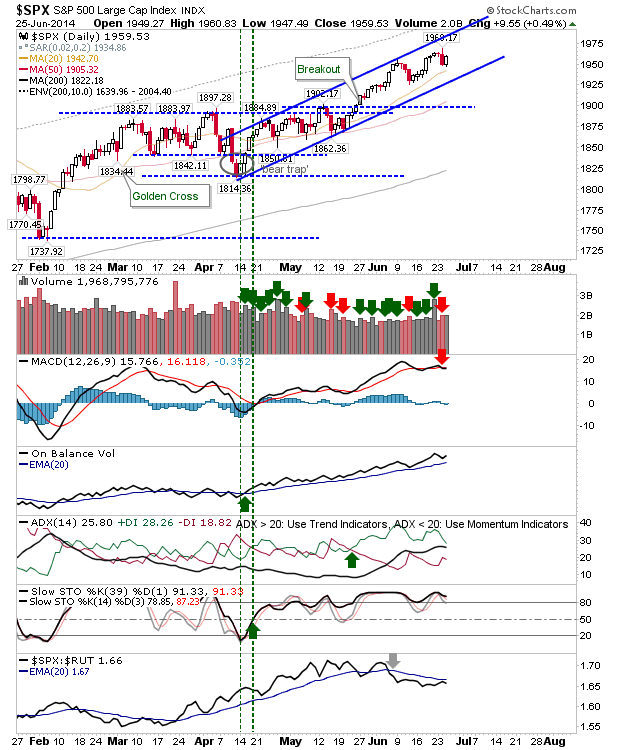

The S&P has been pushed back into the middle of its rising channel. I would prefer to see a test of the 20-day MA and/or lower channel, but this crooked-string style advance from May probably has the legs to get to the 10% 200-day MA Envelope (grey hashed line on chart - currently, 'off screen' at 2,004) without any serious selling to stop it: e.g. a break of the June swing low at 1,925. The MACD is on a 'sell', but it's a very flatlined 'sell' and will be prone to whipsaw. If there was a decisive break of the channel you probably wouldn't want to be holding anything bought within the last year as giving back those profits might prove foolish with hindsight.

The Russell came closest to a channel test at the open. Last week's advance looked tepid, but Wednesday's buying suggested buyers are just waiting from a cue from sellers to step in, and doing so in greater numbers than sellers can create supply for them. This index still looks on course for a test of the March swing high this summer.

The best strategy for long term stock holders who may be wary on this 5-year rally coming to a screaming halt (and even those with profits from holdings less than a year old), is to buy insurance on their positions with an

Option Collar. I don't think we are going to see any crash, but a seasonal September/October flu-like 10-15% sell off would not surprise me. It's probably smart to insure yourself against this - either using current light bullish conditions to build that protection, or waiting until we get the 10% envelope test I suspect we will see in the S&P (probably in August).

The market could of course just keep rising, potentially knocking you out of your positions if the calls component of the collar were exercised, but this should leave you fulfilled with a profit banked and funds to use for the next buying opportunity.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!