Daily Market Commentary: Bears Smash-and-Grab

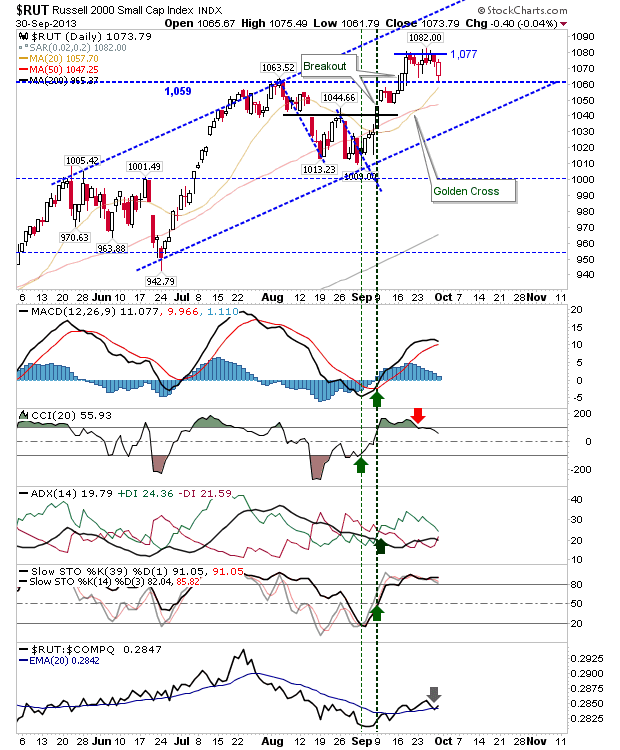

It wasn't pretty - bears played all their cards at market open - but bulls clawed things back (somewhat). The Russell 2000, as the most bullish index, managed to reclaim most of the opening gap loss. The Russell 2000 successfully tested breakout support at 1,059 with the 20-day MA fast approaching to offer additional support. Technicals are okay too, despite weakness in price. Tomorrow is another chance for bulls, but buyers won't tolerate too many days like today. Stop placement remains on a loss of 1,059.

In contrast, the Dow sliced through its 20-day MA after losing its 50-day MA last week. Next stop is rising channel support, which if when tested, is likely to coincide with a convergence of the 200-day MA. Technicals on the verge of a net bearish turn, which will likely be tomorrow, even if there is a gain.

The Nasdaq successfully tested its 20-day MA, although selling volume registered as a distribution day with a 'sell' trigger in On-Balance-Volume.

Ironically, the index which started the weakness was the only one to close higher, with the MACD ending on a 'sell' trigger. The 'bull trap' above 490 is the next challenge, although shorts maintain the edge by virtue of the breakdown.

Longs and Shorts can again play their respective indices with merit: longs can stick with the Russell 2000; shorts with the Semiconductor index or Dow (although latter is extended for a short play).

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

In contrast, the Dow sliced through its 20-day MA after losing its 50-day MA last week. Next stop is rising channel support, which if when tested, is likely to coincide with a convergence of the 200-day MA. Technicals on the verge of a net bearish turn, which will likely be tomorrow, even if there is a gain.

The Nasdaq successfully tested its 20-day MA, although selling volume registered as a distribution day with a 'sell' trigger in On-Balance-Volume.

Ironically, the index which started the weakness was the only one to close higher, with the MACD ending on a 'sell' trigger. The 'bull trap' above 490 is the next challenge, although shorts maintain the edge by virtue of the breakdown.

Longs and Shorts can again play their respective indices with merit: longs can stick with the Russell 2000; shorts with the Semiconductor index or Dow (although latter is extended for a short play).

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!