Daily Market Commentary: Attempting a Swing Low

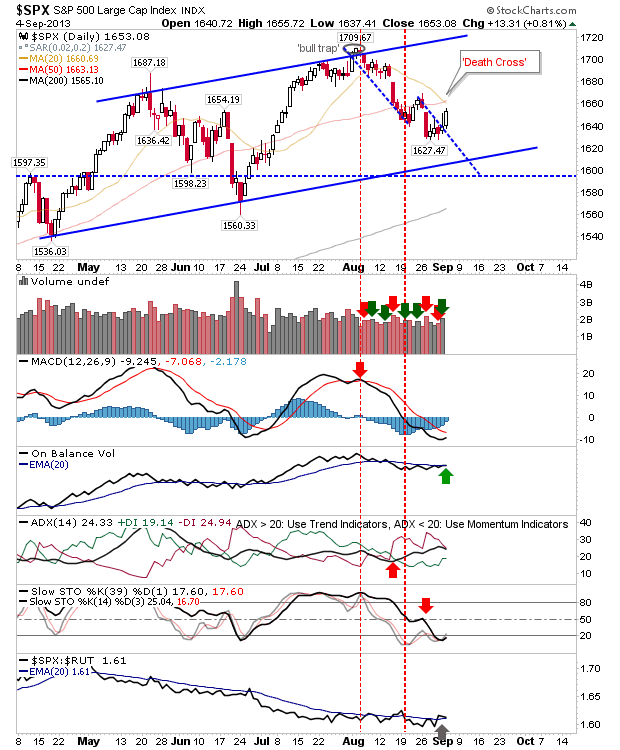

The setup had looked bearish coming into today, but the strong buying over the course of the day has the makings of a tradable swing low. Certainly, recent lows can be used as a break line for long-side stops.

The S&P shaped a 'Death Cross' between 20-day and 50-day MAs, although On-Balance-Volume is on a 'buy' signal. Watch for selling when the 20-day MA is hit.

It's also looking a little easier for the Nasdaq. The 50-day MA is a natural defensive line for long positions. Technicals are improving, with only the MACD on a residual 'sell' trigger, but this looks set to turn bullish soon.

The Russell 2000 is also hovering just above channel support. It too has a convergence of 20-day and 50-day MAs to deal with a supply; tomorrow will be an important test of this.

The Dow had the clearest support 'buy' signal: a picture perfect trigger at channel support despite bearish technicals.

Tomorrow is likely to see the first nascent test of the swing low with overhead 20-day MA resistance. Weakness at this point offers buying opportunities, assuming swing low lows aren't taken out.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P shaped a 'Death Cross' between 20-day and 50-day MAs, although On-Balance-Volume is on a 'buy' signal. Watch for selling when the 20-day MA is hit.

It's also looking a little easier for the Nasdaq. The 50-day MA is a natural defensive line for long positions. Technicals are improving, with only the MACD on a residual 'sell' trigger, but this looks set to turn bullish soon.

The Russell 2000 is also hovering just above channel support. It too has a convergence of 20-day and 50-day MAs to deal with a supply; tomorrow will be an important test of this.

The Dow had the clearest support 'buy' signal: a picture perfect trigger at channel support despite bearish technicals.

Tomorrow is likely to see the first nascent test of the swing low with overhead 20-day MA resistance. Weakness at this point offers buying opportunities, assuming swing low lows aren't taken out.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!