Weekly Market Commentary: Indices Stubborn With Breadth 'Sell'

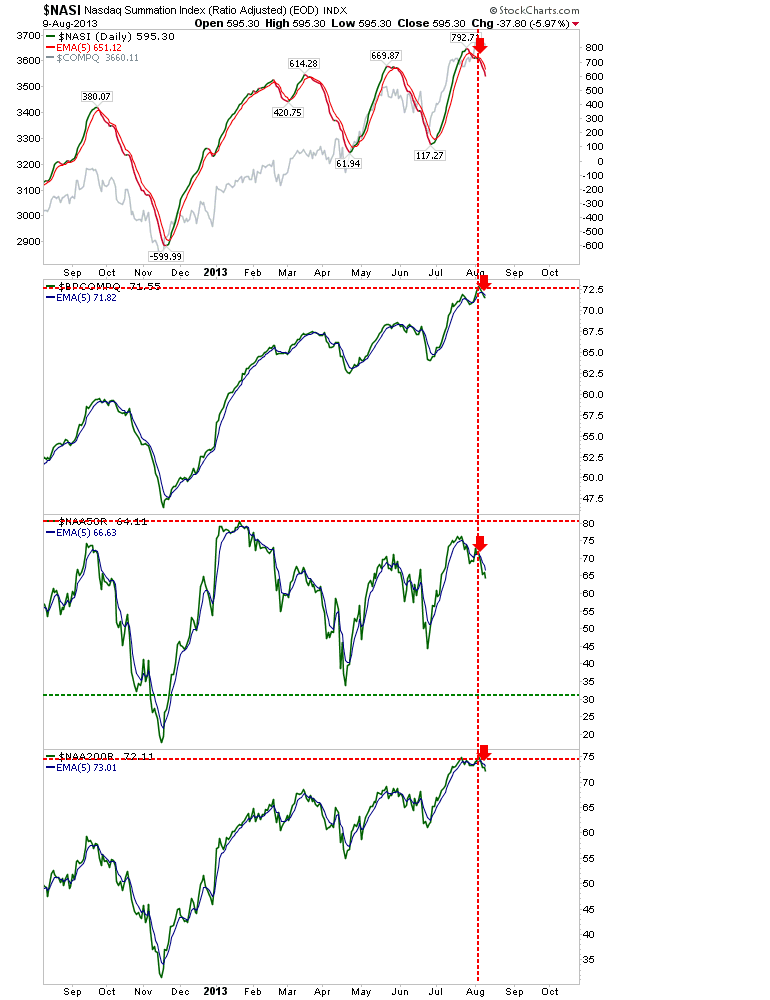

Bears have not turned up despite Breadth 'sell' triggers. Indices continue to hog upper channel lines when profit taking is perhaps the easier option. The Nasdaq Summation Index, Bullish Percents, Percentage of Stocks Above the 50-day MA, and Percentage of Stocks Above the 200-day MA are all on 'sell' triggers.

Although the number of new highs for the NYSE has eased off its peak high: a similar occurrence happened in 2005 and late 2010, but neither signalled an immediate top - although a period of consolidation is likely before the rally resumes; it looks like the market is too strong for a 2008 style crash. The Nasdaq has so far managed to make new peak highs - comparable to 2010, and it too is setting up for consolidation then rally approach.

Small Caps on the weekly continue to attempt an acceleration in the rally as the breakout of the channel holds.

The Nasdaq has nicely honored its channel and the technicals remain strong on the weekly timeframe.

The S&P is positioned mid-channel with is last breakout holding nicely.

Going forward, I suspect the indices will soon start a 6-12 month consolidation before the rally kicks off again. Any stocks trading well above their 200-day MAs should be sold, as the next phase of the rally will likely have different leaders: best to stockpile cash to take advantage than try and ride the old winners. Bears have breadth metrics in their favour, but it's hard to see how a concerted sell off will hold given the number of stocks pushing new all-time highs. Selling covered calls should also do well in this environment.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Although the number of new highs for the NYSE has eased off its peak high: a similar occurrence happened in 2005 and late 2010, but neither signalled an immediate top - although a period of consolidation is likely before the rally resumes; it looks like the market is too strong for a 2008 style crash. The Nasdaq has so far managed to make new peak highs - comparable to 2010, and it too is setting up for consolidation then rally approach.

Small Caps on the weekly continue to attempt an acceleration in the rally as the breakout of the channel holds.

The Nasdaq has nicely honored its channel and the technicals remain strong on the weekly timeframe.

The S&P is positioned mid-channel with is last breakout holding nicely.

Going forward, I suspect the indices will soon start a 6-12 month consolidation before the rally kicks off again. Any stocks trading well above their 200-day MAs should be sold, as the next phase of the rally will likely have different leaders: best to stockpile cash to take advantage than try and ride the old winners. Bears have breadth metrics in their favour, but it's hard to see how a concerted sell off will hold given the number of stocks pushing new all-time highs. Selling covered calls should also do well in this environment.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!