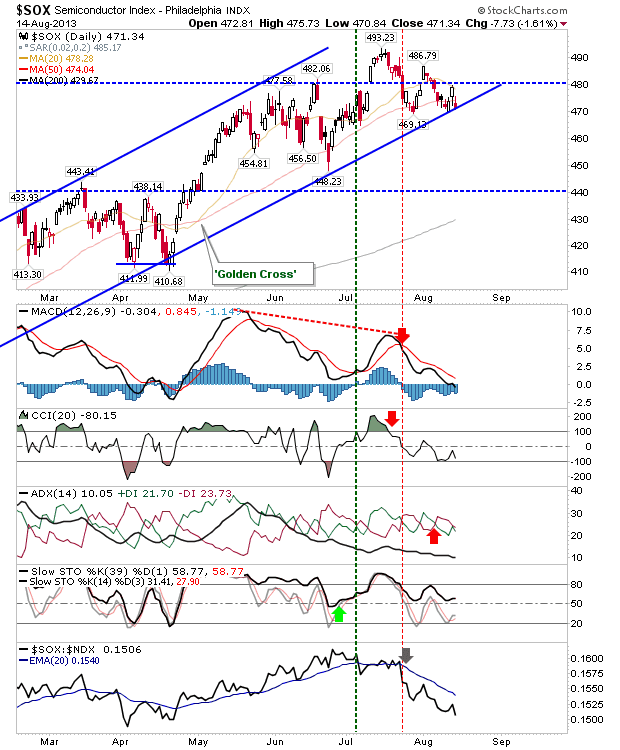

Daily Market Commentary: Semiconductors Gains Undone

Well - that was brief. What looked to be a decent swing low for the Semiconductor Index was undone with today's opening gap down. Luckily, losses didn't build beyond the opening gap down and the index was able to finish on channel support. However, in the process it again lost 50-day MA support. It's an aggressive long, but another gap down would break support and set a bearish tone for the day (although watch for a late day surge to take it back to the channel line).

The Nasdaq held up well despite the losses in the semiconductor index. The 20-day MA has yet to be tested, but should it happen before the 'bull trap' is taken out then a larger decline is likely to emerge. It's not a great place for new positions: a swing trade on break of today's high/low with a stop on the flip side may offer a quick trade.

The S&P fared slightly worse having already lost its 20-day MA. A step down tomorrow would break the 1,680 support level and set up a move to the 50-day MA.

The Russell 2000 is also lingering on the wrong side of its 20-day MA. Support available at 1,038 with a little more wiggle room than the S&P.

Today's losses were small and in themselves are not 'sell' triggers, but you wouldn't want to see too many of them strung together in a row if you are a bull.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq held up well despite the losses in the semiconductor index. The 20-day MA has yet to be tested, but should it happen before the 'bull trap' is taken out then a larger decline is likely to emerge. It's not a great place for new positions: a swing trade on break of today's high/low with a stop on the flip side may offer a quick trade.

The S&P fared slightly worse having already lost its 20-day MA. A step down tomorrow would break the 1,680 support level and set up a move to the 50-day MA.

The Russell 2000 is also lingering on the wrong side of its 20-day MA. Support available at 1,038 with a little more wiggle room than the S&P.

Today's losses were small and in themselves are not 'sell' triggers, but you wouldn't want to see too many of them strung together in a row if you are a bull.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!