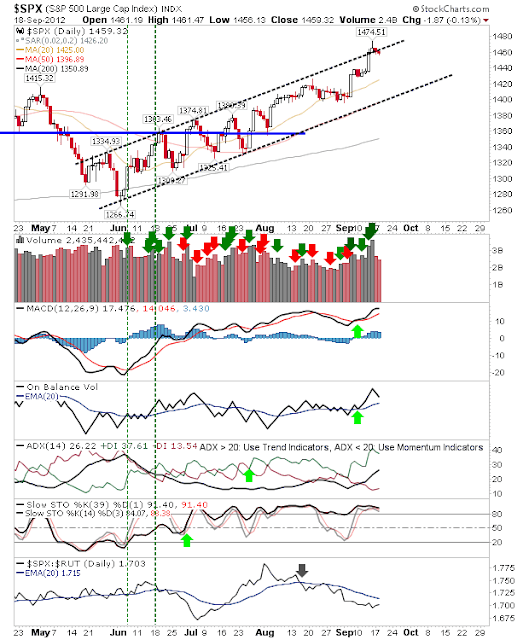

Little to add on yesterday; another day of small losses on light volume. The key aspect to the day was retaining the bulk of last week's gains.

The S&P is lingering around channel resistance. Shorts can use Friday's highs at 1,474 for stop placement and look for a move back to channel support. Technicals are still bullish, so it may take more than a day to reverse the upward trend.

The Nasdaq may offer a 'cleaner' play off channel resistance. Volume rose in line with distribution, but selling was well below last week's buying. Again, the trend is bullish, but the short term offers shorts a little more with a stop above 3,195. Technicals very bullish

The Russell 2000 has no clear daily resistance to consider; although 865 is a significant resistance level on the weekly time frame. Bulls may wish to look to this index for upside as bull markets lead by strength in Small Caps stocks. In relative terms, the Russell 2000 is outperforming both Large Caps and Technology indices, so the basis for further gains is there. It also enjoys net bullish technicals.

For tomorrow, bulls should follow the Russell 2000 and look for a first hour of trading which clears and holds 865. If the market drifts on tomorrow's open following two days of mild losses, then playing the Nasdaq or S&P back to channel support is the preferred option (with a tight stop given the net bullish picture).

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!