Stock Market Commentary: Sentiment Improving

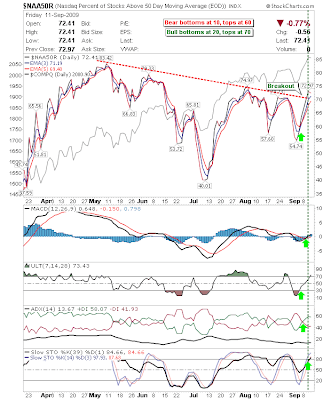

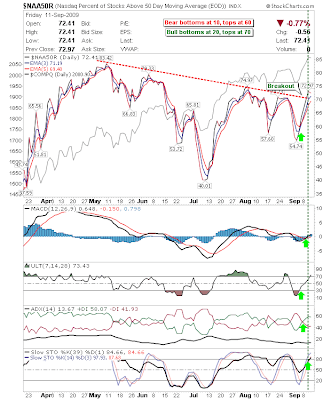

Today's interest wasn't so much the indices but supporting sentiment indicators. The leader was the Percentage of Nasdaq Stocks above the 50-day MA with its break of the bearish divergence and net bullish turn of the technical indicators (from Friday but Monday will have seen further consolidation of this breakout).

The Nasdaq Summation Index is predominantly influenced by the bearish divergence but it has at least managed a bullish cross of its 5-day EMA.

None of this changed the move in the Nasdaq which made a new high on (ever) declining volume.

Driving Tech higher were the semiconductors as last week's resistance breakout held

The market looks like it has more in the tank and has been very resilient; rising channels intact across the board. Nothing more to add.

Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, stock charts, watchlist, multi-currency portfolio manager and strategy builder website. Forex data available too.

The Nasdaq Summation Index is predominantly influenced by the bearish divergence but it has at least managed a bullish cross of its 5-day EMA.

None of this changed the move in the Nasdaq which made a new high on (ever) declining volume.

Driving Tech higher were the semiconductors as last week's resistance breakout held

The market looks like it has more in the tank and has been very resilient; rising channels intact across the board. Nothing more to add.

Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, stock charts, watchlist, multi-currency portfolio manager and strategy builder website. Forex data available too.