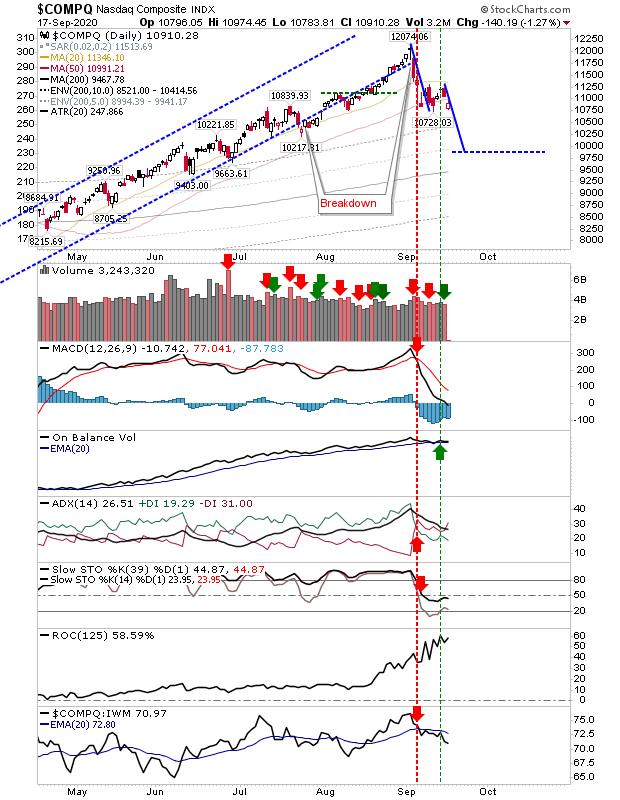

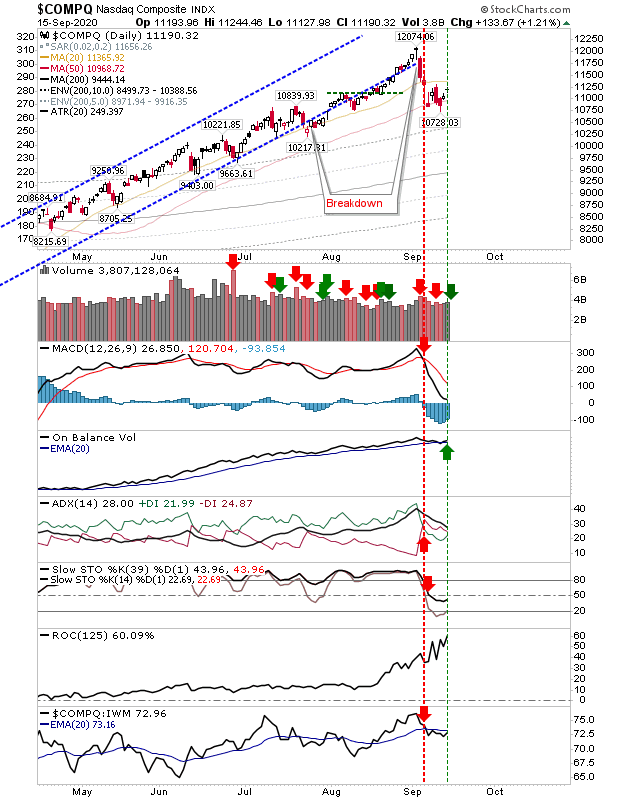

Measured Moves Down In Play for S&P and Nasdaq

Friday's selling sees a break in the 50-day MA for the S&P, following the lead of the Nasdaq from last week. Selling volume climbed in confirmed distribution across the indices. The measured move targets for both these indices remain in play with each swing low likely to breached Monday. Not surprisingly, technicals for the S&P and Nasdaq are both net bearish.