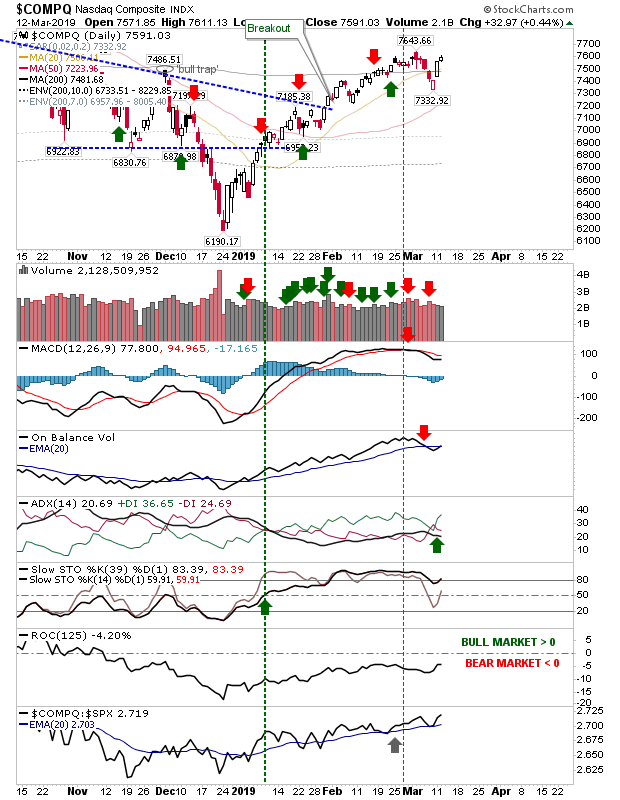

Monday's gains consolidated

There wasn't a whole lot to add to today's action but the best thing that could be said was that yesterday's gains held. The Nasdaq added near 0.5% as prior 'sell' triggers began to reverse; first was +DI/-DI. However, On-Balance-Volume and the MACD are still on 'sell' triggers. Relative performance has also managed a new multi-month high, perhaps enough to help break the 7,643 high.