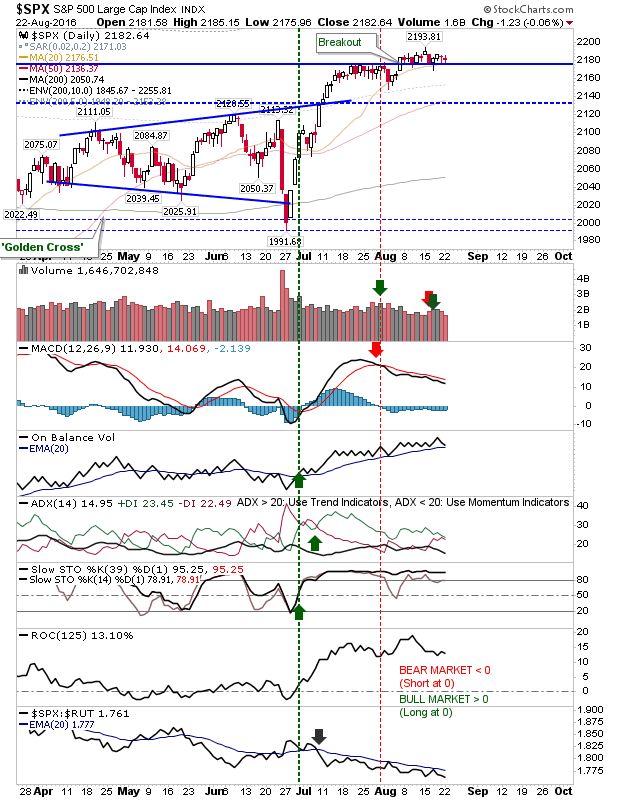

The weak start didn't deliver a rout in markets. Instead, after the obligatory first half-hour of trading came the (bullish) reversal which lasted the rest of the day. The overall picture hasn't changed, with the S&P stuck inside a narrow range, but a panic sell-off looks less likely now. Buyers look keen to defend drops below 2,170 in the S&P. Volume climbed to register accumulation, despite general holiday volumes. Bulls will want to see a fresh MACD 'buy' to confirm an end to an effective 7-week consolidation. Aggressive traders can look to the 20-day MA for buying opportunities and/or trailing stops.