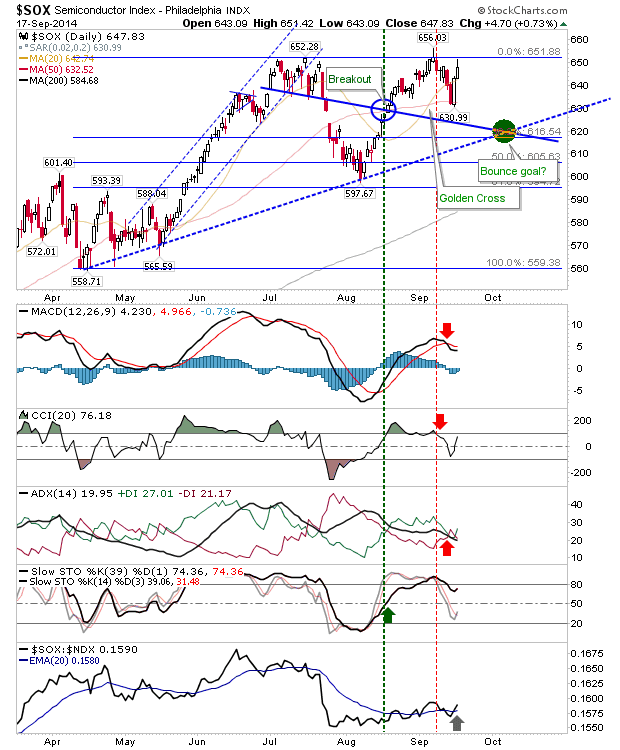

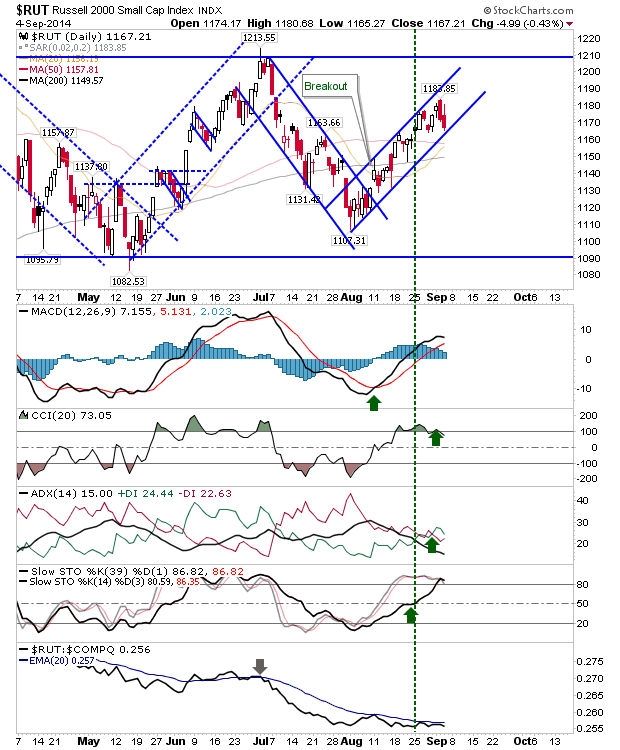

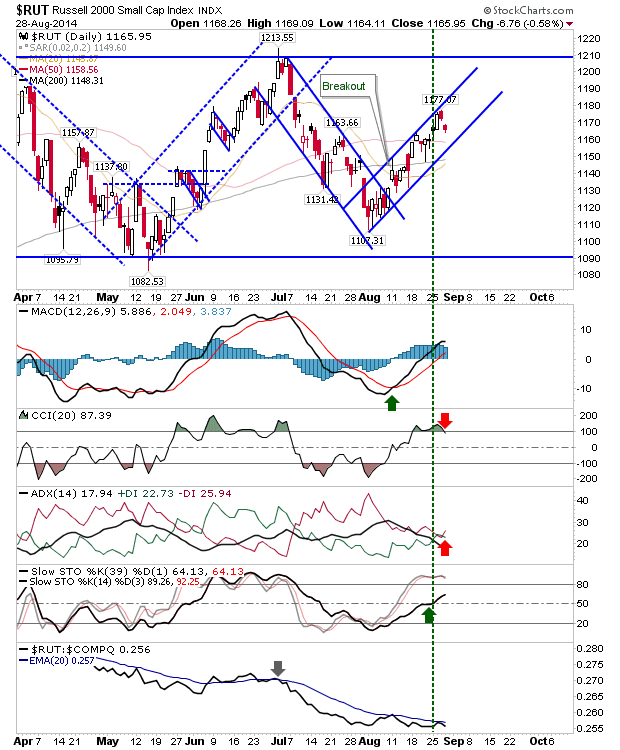

Daily Market Commentary: Higher Volume Selling, and Bearish Engulfing Pattern in Russell 2000 and Semiconductor Index

In day when Alibaba took the headlines , it was left to the Russell 2000 and Semiconductor Index to warn of potential change. The Russell 2000 experienced a large bearish engulfing pattern, although within the boundaries of the declining channel. There was an undercut of the 200-day MA, which will need to be watched on Monday. Shorts could get aggressive with a stop above 1,164 (and/or declining channel line).