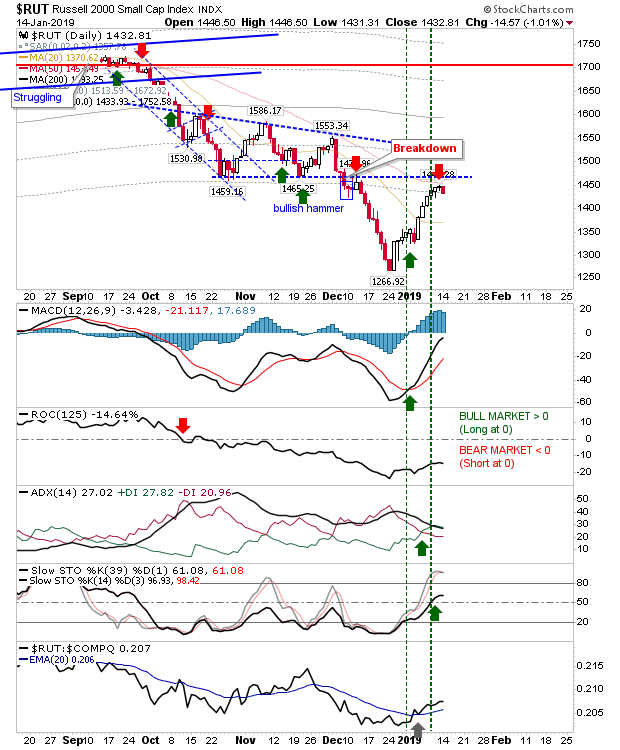

Swing trade breaks in Shorts favour but no follow through lower.

From a pure price perspective, the suggested swing trades broke to the downside, but the lack of follow-through beyond the opening hour doesn't suggest shorts are going to win here. However, until last Thursday's/Friday's highs are breached the short plays can probably be held until they are decisively beaten. Ohers could look to a hedge with a long trade using a stop on a break of today's lows. With long/short covered the risk is whipsaw.

The Russell 2000 was the only index to finish with a lower close and if shorts are going to win out then this is likely to be the index to deliver.

Large Cap indices had offered a more ideal technical shorting opportunity at resistance but both the S&P and Dow Index managed to recover from the weak opening.

Tech averages still have the best long-side opportunity with the doji above support; shorts may have taken the gap down as an entry opportunity but as there was no follow-through stops will need to be kept tight.

For tomorrow, with a weak short trade in play it will be a question of managing risk; be prepared to switch long if last Thursday's highs are breached. Whipsaw is the biggest enemy here.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

Investments are held in a pension fund on a buy-and-hold strategy.

.

The Russell 2000 was the only index to finish with a lower close and if shorts are going to win out then this is likely to be the index to deliver.

Large Cap indices had offered a more ideal technical shorting opportunity at resistance but both the S&P and Dow Index managed to recover from the weak opening.

Tech averages still have the best long-side opportunity with the doji above support; shorts may have taken the gap down as an entry opportunity but as there was no follow-through stops will need to be kept tight.

For tomorrow, with a weak short trade in play it will be a question of managing risk; be prepared to switch long if last Thursday's highs are breached. Whipsaw is the biggest enemy here.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

.